Welcome to the only money guide for Ireland you’ll ever need. This isn't just another stuffy financial textbook; it’s your practical control panel for getting a real grip on your finances. Whether you're just starting your career, trying to get your head around your money, or even launching a business, we're going to give you the confidence to take control.

Getting Started: The Basics of Managing Your Money in Ireland

Feeling a bit lost with Irish personal finance? You're not alone. The good news is that it all boils down to a few core ideas. Think of this as your quick-start guide to getting your day-to-day money sorted, minus all the confusing jargon. We'll focus on the practical steps that actually move the needle.

Let's try looking at your finances like you're running a small business. You've got money coming in (your revenue), money going out (your costs), and hopefully, some left over at the end of the month (your profit, or savings). The whole game is about managing that flow of cash to build a solid, stable future. And it all starts with nailing the basics.

Your Irish Personal Finance Quick Start Checklist

To get the ball rolling, here’s a simple checklist to walk you through the first few crucial steps. Getting these things organised is the first, and most important, part of the journey.

| Action Step | Why It's Important | Top Tip |

|---|---|---|

| Get a Clear Picture of Your Income | You need to know your net pay – the actual amount that lands in your bank account after tax. | Don't budget based on your gross salary. Look at your payslip and use the post-tax figure for all your planning. |

| Track Your Spending for a Month | This isn't about judging your choices; it's about seeing exactly where your money is going. Awareness is everything. | Use a simple app or even a notebook. The goal is just to gather data without changing your habits initially. |

| Create a Simple Budget | A budget gives your money a job to do, helping you direct it towards what really matters to you. | Start with the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. |

| Open a Separate Savings Account | Keeping your savings away from your everyday spending account makes it much harder to dip into them. | Look for a high-interest savings account. Even a small difference in the interest rate adds up over time. |

Once you've ticked these off, you'll already feel more in control. It’s all about creating a system that works for you.

Building Your Financial Foundation

The very first step in any decent financial plan is simply knowing what you have and where it's all going. This means getting crystal clear on your income after all the taxes are taken out—your net pay—and then figuring out your spending habits. So many people get hung up on their gross salary, but the only number that really matters is the one that actually hits your bank account.

Once you know what you’re working with, you can build a budget. Forget thinking of it as a restrictive financial diet; a budget is just a roadmap for your money. It’s you telling your money where to go, instead of wondering where it all went at the end of the month. If you want to get really serious about this, especially when things feel a bit uncertain, have a look at our guide on protecting and understanding your cash flow.

When you get budgeting right, saving becomes almost automatic. Recent figures show that Irish households are getting the message; in Q2 2025, the saving rate was 12.5%. That means for every €8 people had left after tax, they were saving about €1. It’s a sign that people are making a real effort to put money aside, which is probably the most important habit for long-term financial health. You can see more on this from the CSO.

"Your financial foundation is built on three pillars: knowing what you earn, controlling what you spend, and consistently setting aside a portion for the future. Master these, and you're on the path to financial control."

Creating Your Safety Net

An emergency fund isn’t just a nice-to-have; it’s non-negotiable. This is your pot of cash, kept completely separate from your daily bank account, purely for life's nasty surprises—like losing your job or getting hit with a sudden medical bill. The rule of thumb is to have three to six months' worth of essential living expenses tucked away.

Think of it as your own personal financial insurance. You hope you never have to use it, but you'll be incredibly glad it's there if you do. It's what stops a single unexpected event from derailing all your long-term goals or forcing you into debt. The easiest way to build it? Set up an automatic transfer to a separate savings account for the day you get paid. It’s a simple trick, but it’s powerful.

Once you have these fundamentals—banking, budgeting, and an emergency fund—sorted, you've built the launchpad for everything else. With your daily money under control, you can start looking at the bigger picture. And if you’re new to all of this, a good guide on how to start investing for beginners is a great next step to start thinking about future growth.

Understanding Your Irish Payslip, Pensions, and Benefits

Getting your first payslip can be a bit of a shock. You see the big number you were promised in the interview (your gross pay), and then you see the much smaller number that actually hits your bank account (your net pay). Figuring out where the rest went is step one in getting to grips with your money in Ireland.

It’s actually quite straightforward once you know what’s what. The Irish government takes its share for taxes and social insurance before the money even gets to you. This system is called Pay As You Earn (PAYE), and while it’s designed to be simple, it’s worth knowing exactly what you’re paying for.

Think of it like this: your payslip is the starting point for everything else. Once you understand your income, you can tackle the other core pillars of your financial life.

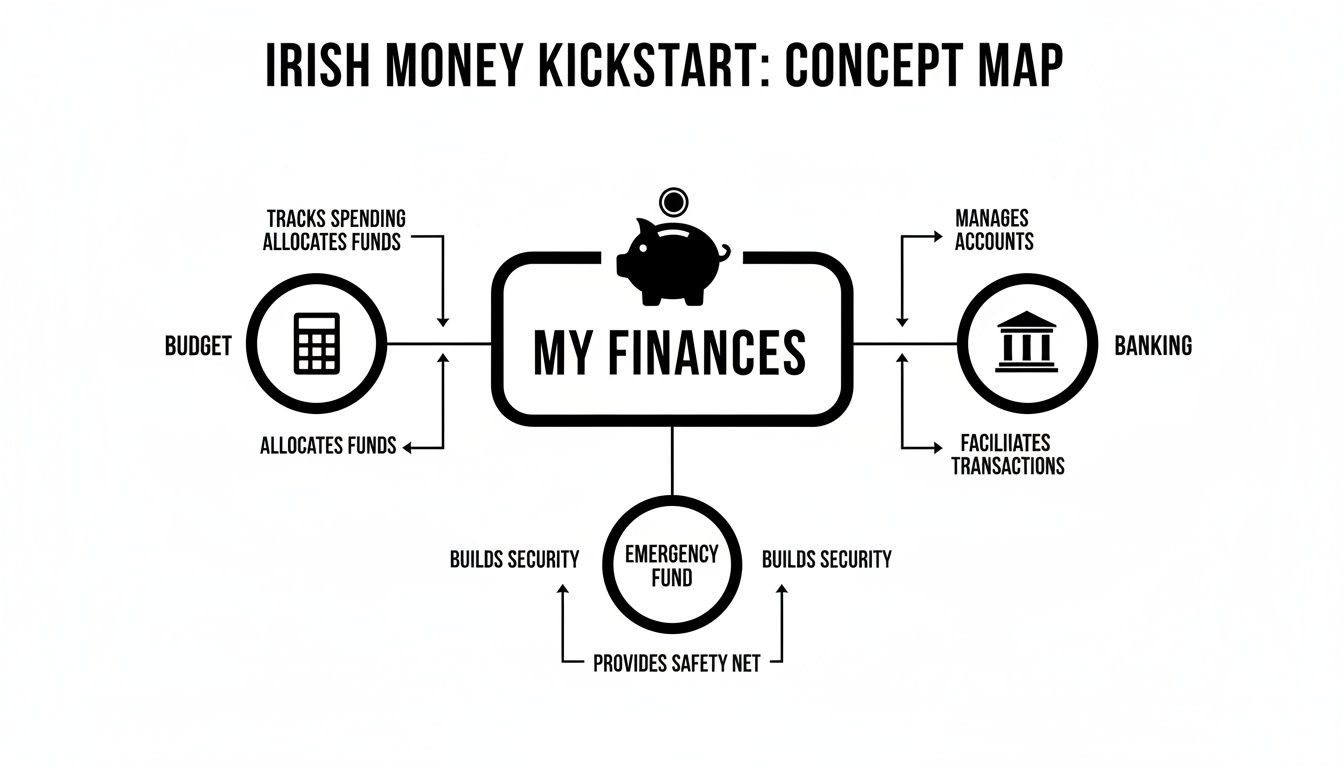

This map shows how a solid handle on your finances starts with the basics: budgeting, banking, and building that all-important emergency fund.

The Big Three Deductions Explained

Before we get into the specifics on your payslip, it's really helpful to get your head around the basic idea of understanding gross vs. net income. Once you’ve got that down, you’ll see that three main deductions pop up on pretty much every Irish payslip.

Let's cut through the jargon and break them down.

- PAYE (Pay As You Earn): This is just your income tax. The amount you pay is worked out based on your earnings and your personal tax credits. The best way to think of tax credits is as a discount on your final tax bill. Everyone gets a standard amount, but you might qualify for more depending on your situation, like if you're married or a single parent.

- USC (Universal Social Charge): This is another tax on your income, plain and simple. It was brought in during the last financial crisis and just never left. The percentage you pay goes up as your income does, so higher earners pay a larger slice.

- PRSI (Pay Related Social Insurance): This one isn't a tax—it's more like a contribution. Think of it as paying into a national insurance fund. Your PRSI payments build up your entitlement to social welfare benefits, like the State Pension, Jobseeker's Benefit, or Maternity Benefit. It's the system that supports you at different stages of your life.

Getting to know these three is the real key to understanding exactly where your money is going each payday.

Planning for Your Future: Pensions

Pensions can feel like a problem for ‘future you’ to worry about, but the single biggest advantage you can have is time. It’s all down to the magic of compound interest. A small amount saved in your 20s can easily grow to be worth more than a much larger amount saved in your 40s.

In Ireland, there are generally two paths you can take:

- Workplace Pensions: Lots of employers offer these, and many will even match your contributions up to a certain point. This is basically free money, so if your company offers it, you should absolutely grab it with both hands.

- Personal Retirement Savings Accounts (PRSAs): If your employer doesn’t have a pension scheme, or if you're self-employed, a PRSA is a great option. It’s a flexible private pension that you set up and manage yourself.

The best time to start a pension was yesterday. The next best time is today. Getting started, no matter how small, puts time and compounding on your side.

Knowing Your Social Welfare Benefits

Those PRSI contributions we mentioned aren't just disappearing into a black hole. They’re your ticket to a whole range of social welfare supports that act as a safety net when life throws you a curveball.

There are dozens of different payments, but some of the most common ones you'll come across include:

- Jobseeker's Benefit: Support if you lose your job while you’re looking for a new one.

- Illness Benefit: A short-term payment if you’re too sick to work.

- Maternity and Paternity Benefit: Financial support to help you take time off with a new baby.

- State Pension (Contributory): This is the big one. It's the payment you get from the government when you retire, and the amount you receive is based on how many PRSI contributions you made throughout your working life.

Knowing these benefits are there gives you real peace of mind. It shows that the system you pay into is designed to pay you back, supporting you through life’s ups and downs.

Getting a Handle on Mortgages and Personal Loans in Ireland

Stepping onto the property ladder or taking out a big loan can feel like a massive, nerve-wracking leap. It’s one of those grown-up financial moments that nobody really prepares you for. But it doesn't have to be so intimidating. Let's break down how mortgages and personal loans work in Ireland, so you can walk in feeling prepared, not panicked.

For most people, buying a home is the biggest financial goal they'll ever have. The journey doesn't start with house viewings, though. It starts with saving. You'll generally need a deposit of at least 10% of the property’s price if you're a first-time buyer. That's a serious chunk of change, but thankfully, there are some government schemes designed to give you a leg up.

So, What's the Deal with Mortgages?

At its heart, a mortgage is just a huge loan you get from a bank to buy a property. You agree to pay it back, plus interest, over a long time—usually up to 35 years. Before any bank hands over that kind of cash, they're going to put your finances under a microscope to make sure you're a safe bet.

Here’s what they’re really looking for:

- Proof You Can Pay: This is what they call 'Repayment Capacity'. Have you been consistently saving a good amount each month? Or paying a hefty rent without any issues? They want to see a solid history that proves you can handle the monthly mortgage payments.

- A Squeaky-Clean Credit History: Every loan, credit card, or overdraft you've had is recorded by the Central Credit Register (CCR). Lenders will pull this report to see if you've been responsible with debt in the past.

- A Steady Job: Nothing says "reliable borrower" like a permanent, full-time job. It gives the bank confidence that you’ll have a stable income to cover your repayments for the long haul.

A real game-changer for first-time buyers is the Help to Buy (HTB) incentive. This brilliant scheme allows you to claim back the income tax and DIRT you've paid over the last four years. You can get up to €30,000, which can make a massive dent in your deposit and get you into your own home much faster.

Fixed vs. Variable Rates: What’s the Difference?

Once you’re approved, you’ll have to make a big decision: fixed or variable interest rate? Think of it as choosing certainty versus a bit of a gamble.

- Fixed Rate: You lock in your interest rate for a set period, often two to five years. Your monthly repayments won't change an inch during that time, which is fantastic for budgeting and gives you real peace of mind.

- Variable Rate: This rate moves with the market, so it can go up or down. You might start with a lower repayment, but you’re also taking the risk that it could rise, making your monthly bill less predictable.

Which one is right for you? It all comes down to how comfortable you are with risk. If you like stability, fixed is your friend. If you don't mind a bit of uncertainty for a potentially lower rate, variable might be the way to go.

Your mortgage application is essentially your financial CV. The bank wants to see a story of responsibility and good planning. Your best evidence? A well-managed bank account and a consistent savings habit.

Personal Loans for Everything Else

Of course, not all big expenses involve buying a house. People take out personal loans for all sorts of things, from buying a car and doing up the kitchen to simply getting all their other debts rolled into one manageable payment.

And it's a growing trend. The first half of 2025 saw a real surge in personal lending. In the second quarter alone, a whopping 70,958 personal loans were taken out, totalling €754 million. That's a 16.9% increase in just one year, driven mostly by car finance, home improvements, and "green" loans for eco-friendly upgrades. You can dive deeper into the Irish personal lending trends to see the full picture.

Whether it’s for a mortgage or a new car, the golden rule of borrowing is the same: only take on what you know you can pay back. Always shop around to find the lowest interest rate possible—it could easily save you hundreds, if not thousands, over the life of the loan. Managing your borrowing wisely is a cornerstone of the solid financial plan we're building in this money guide for Ireland.

Investing in Ireland to Build Long-Term Wealth

Putting money into a savings account feels safe, but let's be honest, it's investing that gives your money the chance to actually grow. This part of the guide is your starting point for getting to grips with the investment world here in Ireland. We’ll look at the real options that can help you build proper, long-term wealth.

Think of it like this: saving is parking your money in a secure garage. It’s safe, it’s sound, but it’s not really going anywhere. Investing is more like putting your money to work—sending it out on a journey where it has the potential to grow and bring back more than you started with.

Making that shift from a saver’s mindset to an investor’s can be a big one. And it’s a hurdle for many in Ireland. Research from the BPFI shows that while we’re pretty good at putting money aside, we tend to favour short-term savings over long-term investments. A commissioned survey found that while three-quarters of people had set money aside, over a third of savers held less than €5,000, and the uptake of investment products was surprisingly low. You can see more on Irish savings and spending habits here.

Getting Started with Common Investments

Dipping your toe into investing doesn't have to be some overly complicated, stressful event. You certainly don't need to become a stock-picking genius overnight. For most people just starting out, funds are a much more accessible and frankly, sensible route.

Funds are basically big pots of money where lots of investors pool their cash together. A fund manager then uses that pool to buy a wide range of assets, like shares in hundreds of different companies or government bonds. The beauty of this is automatic diversification—a fancy way of saying you're not putting all your eggs in one basket.

Here are a few popular options you'll come across in Ireland:

- Exchange-Traded Funds (ETFs): These are funds that trade on stock exchanges, just like individual company shares. They often track a market index, like the S&P 500 (the 500 biggest companies in the US), giving you a piece of the entire market in one simple transaction.

- Investment Trusts: These are actually companies set up for the sole purpose of investing in the shares of other companies. You buy shares in the investment trust itself, and its success is tied to the investments it holds.

- Mutual Funds: Actively managed by professionals, these funds invest in a diverse mix of stocks, bonds, and other assets. If you want to dive deeper, we have a complete guide on how mutual funds work in Ireland.

To make it a bit clearer, here's a quick breakdown of how these options stack up against each other.

Common Investment Options in Ireland

| Investment Type | Typical Risk Level | Key Tax Consideration | Best For |

|---|---|---|---|

| ETFs | Medium-High | Deemed Disposal every 8 years (41% Exit Tax) | Low-cost, passive investors wanting broad market exposure. |

| Investment Trusts | Medium-High | Capital Gains Tax (33%) on disposal. | Investors comfortable with company structures, potential for discounts. |

| Mutual Funds | Varies (Low-High) | Deemed Disposal every 8 years (41% Exit Tax) | Those who prefer a hands-off approach with professional management. |

| Individual Stocks | High | Capital Gains Tax (33%) on disposal. | Experienced investors who enjoy researching and picking companies. |

This table is just a starting point, of course. The 'best for' really depends on your personal goals, timeline, and how much risk you're comfortable with.

Understanding the Unique Irish Tax Rules

Investing in Ireland comes with its own very specific set of tax rules, and it’s absolutely crucial to get your head around them. The most unique, and often misunderstood, is the Deemed Disposal rule, which mainly hits ETFs and other funds.

Under this rule, you are taxed on any gains your investment has made every eight years, even if you haven’t sold a single thing. The tax, called Exit Tax, is currently 41% on the profits. It was brought in to stop people from holding onto assets forever just to avoid paying tax.

Think of Deemed Disposal as a tax checkpoint. Every eight years, Revenue takes a look at how much your investment has grown and asks for its share, whether you’ve cashed out or not. It’s a key quirk you have to factor into any long-term investment plan in Ireland.

It can sound a bit intimidating at first, but it's just something you need to plan for. It simply means being aware of the eight-year anniversary of your investments and making sure you have the cash set aside to cover any potential tax bill.

Your Pension: The Ultimate Investment Tool

We’ve already touched on pensions, but it’s worth shouting about it again: your pension is hands down one of the most powerful and tax-efficient investment tools you will ever have. It's not just a savings account for your old age; it’s a dedicated investment fund with massive tax advantages.

When you put money into a pension, you get tax relief at your top rate. That means if you're a higher-rate taxpayer (40%), every €60 you personally contribute instantly becomes €100 inside your pension fund. The government effectively tops it up with the €40 you would have paid in tax.

Better still, inside the pension fund, all your investments grow completely tax-free. No Capital Gains Tax, no DIRT, and importantly, no dreaded Deemed Disposal. This lets your money compound far more powerfully over the decades, building a much bigger pot for your retirement than you could ever manage otherwise. It truly is the cornerstone of building long-term wealth in this money guide for Ireland.

Your Financial Guide to Launching an Irish Business

Moving from managing your own money to steering the finances of a new business can feel like a massive leap. It's a whole new world with its own language and rules. But you don't have to go into it blind.

Launching a business in Ireland is incredibly rewarding, but you need a solid plan. Think of it like this: your idea is the destination, but you still need to build the ship, stock it with supplies (that's your funding), and learn how to navigate the local waters (taxes and regulations). This section is your map.

Securing the Fuel for Your Venture

Every business needs cash to get going, but how you get it depends entirely on your situation. The right funding path for you hinges on your business model, how fast you want to grow, and, crucially, how much control you're willing to part with.

Here’s a look at the most common routes founders take in Ireland:

- Bootstrapping: This is the ultimate DIY method. You use your own savings or whatever cash the business generates from early sales to fund everything. Growth is often slower, but you keep 100% control of your company. It’s your baby, and you call all the shots.

- Angel Investors: These are typically successful entrepreneurs or wealthy individuals who invest their own money into promising startups in exchange for a slice of the company (equity). They’re often more than just a cheque; many bring invaluable experience and contacts, acting as a mentor in those tricky early days.

- Venture Capital (VC): VC firms are the big leagues. They manage large pools of money and invest in businesses they believe have the potential for massive growth. They’ll want a significant chunk of equity and a seat on your board, taking an active role in shaping the company’s future for a huge potential payday down the road.

Securing funding is less about asking for money and more about selling a vision. Investors aren't just buying a piece of your company; they're buying into your ability to execute a plan and create significant value.

Tapping into State Support

One of the best things about starting a business in Ireland is the incredible level of state support available. The government is genuinely invested in seeing new companies succeed, and there are some fantastic resources out there.

Enterprise Ireland is the main agency you need to know. They’re tasked with helping Irish businesses grow and compete internationally. They offer everything from small grants to test an idea, right up to major equity investments in what they call High Potential Start-Ups (HPSUs). Getting their backing is a huge vote of confidence and can make it much easier to attract other investors.

Laying the Right Legal and Tax Foundations

Before you even think about chasing funding, you need to get your house in order. Your very first big decision is choosing the right legal structure for your business.

In Ireland, you’ve got three main options:

- Sole Trader: This is the simplest way to get started. You are the business. All the profits are just treated as your personal income. It’s quick and easy, but there's a big catch: you have no legal protection. If things go wrong, your personal assets are on the line.

- Partnership: It's basically the same as being a sole trader, but for two or more people. Again, it’s simple, but there’s no legal separation between the partners and the business.

- Limited Company (LTD): This is the go-to structure for most ambitious startups. It creates a separate legal entity, meaning the company’s finances are totally separate from your own. This gives you "limited liability," protecting your personal assets.

Once you’re registered as a company, you’ll be introduced to the world of Corporation Tax. Ireland is famous for its low rate of 12.5% on trading profits, which is a massive draw for businesses. Getting your head around this from day one is absolutely essential.

From the moment you start, managing your finances properly is what will keep you afloat. A good first step is to check out the best accounting and bookkeeping software for your needs. The right tool will save you a world of pain and give you the clear data you need to make smart decisions. Getting these foundations right is a cornerstone of any good money guide for Ireland—and for building a business that lasts.

Got Questions About Managing Your Money in Ireland?

Navigating your finances in Ireland can sometimes feel like you're missing a piece of the puzzle. Even with a decent plan, you'll inevitably hit a specific query or wonder if you're making the right move. Think of this section as your go-to for those common money head-scratchers.

We've pulled together some of the questions we hear all the time to give you clear, no-nonsense answers. From getting your head around credit history to figuring out if you need to call in a pro, this is all about filling in the gaps and making you feel more confident with your cash.

How Does the Credit Score System Work in Ireland?

You’ve probably heard people talking about "credit scores," especially in American TV programmes, but the setup here in Ireland is a bit different. We don't actually have a single, all-powerful score that follows you around. Instead, we have the Central Credit Register (CCR), which is run by the Central Bank of Ireland.

The best way to think of the CCR is as a factual report card on your borrowing habits. It keeps a record of all your loans over €500 – that includes mortgages, personal loans, credit cards, and even your overdraft. It simply shows lenders whether you've been good at making your repayments on time or if you've slipped up.

So, how do you build a good credit history? It really boils down to basics:

- Pay on time, every single time. This is the golden rule. Consistency proves to lenders that you're a safe bet.

- Don't go on a credit application spree. Firing off multiple applications in a short space of time can look a bit desperate and acts as a red flag.

- Check your report regularly. You're entitled to a free copy of your own credit report, so it's worth getting it to make sure everything looks right.

A solid credit history is what will open doors for you later, especially when you're looking for bigger loans like a mortgage.

What Is the Best Way to Start Saving if I Have Debt?

Trying to save money while you’re paying off debt can feel like you're trying to run in two opposite directions at once. It’s a classic financial tug-of-war, but there’s absolutely a smart way to handle it. The trick is to find a balance instead of going all-in on one goal and neglecting the other.

Most financial experts agree you should tackle both at the same time, but you need a strategy. Your very first priority should be to build a small emergency fund. We’re not talking about a huge amount – even just €500 to €1,000 will do. This little pot of cash is what will stop a broken-down car from forcing you into more debt.

Once that safety net is in place, you can get more aggressive with clearing your debt. Two of the most popular approaches are:

- The Debt Avalanche: You throw every spare cent at the debt with the highest interest rate first. Mathematically, this saves you the most money in the long run.

- The Debt Snowball: You focus on paying off your smallest debt first, whatever the interest rate. Getting that quick win gives you a huge motivational kick to keep going.

Which one is best? It honestly comes down to your personality. The most important thing is simply to have a plan and stick to it.

Balancing saving and debt repayment isn't an either/or choice. It's about creating a system where you build a safety net for your future while actively chipping away at the burdens of your past.

Do I Need a Financial Adviser in Ireland?

This is a great question, and the honest-to-goodness answer is: it depends. For your day-to-day money management – things like budgeting and general saving – you can get incredibly far on your own with a good guide like this one. But there are definitely moments in life when getting professional advice is one of the smartest things you can do.

A good financial adviser can be a game-changer when you're up against big, complicated decisions. Think of them as a personal trainer for your finances; they help you define your goals, map out a clear plan to get there, and keep you accountable along the way.

You should seriously consider talking to one if you are:

- Planning for retirement: They can help you figure out the magic number you need to save and the best vehicles (like pensions) to get you there.

- Dealing with a large sum of money: This could be anything from an inheritance to a redundancy payment. An adviser helps you make that money work for you, not just disappear.

- Looking at complex investments: If you want to move beyond the basics, an adviser can walk you through the options and, crucially, the tax implications.

When you're looking for an adviser, the one non-negotiable is to make sure they are regulated by the Central Bank of Ireland. This is your guarantee that they meet professional and ethical standards. A great adviser will take the time to really understand your personal circumstances, making them a vital part of any solid money guide for Ireland.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.