Figuring out if Ripple (XRP) is a good investment is a bit more complicated than a simple "yes" or "no". It's really about how much you believe in its mission to shake up the world of international finance, and how much risk you're comfortable with along the way. Think of this guide as your roadmap to understanding the tech, the real-world applications, and the market story behind XRP.

Charting the Course for a Ripple Investment

Before you can decide if Ripple fits in your portfolio, you need to get what it’s actually trying to do. Ripple isn’t out to replace cash or become the next Bitcoin. It's a technology company on a very specific mission: making international payments for banks and big financial players faster, cheaper, and way more efficient.

Think about how money moves across borders right now. The main system, SWIFT, is notoriously slow and clunky. A simple transfer can take days to clear because it has to hop between several banks, and each one takes a fee. Ripple wants to tear up that old playbook and replace it with its own payment network, RippleNet.

So, Where Does the XRP Token Fit In?

This is where the XRP token comes into the picture. Inside the RippleNet network, XRP is designed to act as a go-between, or a “bridge currency,” to settle transactions almost instantly.

Let's say a bank in Dublin wants to send euros to a bank in Tokyo. Normally, this is a slow process. With Ripple, the Dublin bank could convert euros to XRP, send the XRP, and the Tokyo bank could convert it to yen—all in just a few seconds. This sidesteps the need for the old, slow correspondent banking system.

This sharp focus on a genuine business problem is what makes Ripple different from thousands of other crypto projects. The case for investing in XRP isn't just based on hype or speculation; it’s directly linked to whether or not the global banking industry actually adopts its technology.

The Big Idea: Ripple is aiming to become the default plumbing for institutional cross-border payments. Its success hinges entirely on convincing the world’s financial giants to ditch a system they’ve relied on for decades.

Ripple (XRP) Investment At a Glance

To give you a quick snapshot, let's break down the core arguments for and against investing in XRP. This table summarises the main points to consider.

| Key Strengths (Potential Upside) | Key Risks (Potential Downside) |

|---|---|

| Clear Real-World Use Case: Aims to solve a tangible problem in the £120+ trillion cross-border payments market. | Regulatory Uncertainty: The long-running lawsuit with the US SEC has created major price volatility and FUD (Fear, Uncertainty, and Doubt). |

| Established Partnerships: Works with hundreds of financial institutions globally, including major banks. | Centralisation Concerns: Unlike Bitcoin, Ripple (the company) plays a significant role in the network, which worries some crypto purists. |

| Speed and Low Cost: Transactions settle in 3-5 seconds for a fraction of a penny, a huge advantage over traditional systems. | Fierce Competition: Faces competition from established players like SWIFT (which is upgrading its own systems) and other blockchain projects. |

| Experienced Leadership: Backed by a team with deep experience in both finance and technology. | Adoption Is a Marathon: Convincing conservative financial institutions to adopt new tech is a slow, uphill battle. |

This table should help you see the bigger picture. XRP isn't a get-rich-quick scheme; it's a long-term play with some very real potential and equally real obstacles.

Balancing the Potential with the Pitfalls

As you can see, Ripple's ambitious vision comes with some serious challenges. Its journey has been a rollercoaster of exciting partnerships and persistent regulatory headaches, especially the drawn-out legal battle with the U.S. Securities and Exchange Commission (SEC). That lawsuit alone has cast a long shadow, creating huge uncertainty for investors.

So, when you're weighing up an investment in Ripple, you're essentially betting on one of two outcomes:

- The Bull Case: RippleNet gets widely adopted, making XRP a critical part of the global financial system. This would almost certainly drive its value up significantly.

- The Bear Case: Regulatory hurdles, stiff competition, or just plain old institutional resistance stall its growth, leaving it as a high-risk asset that never quite lived up to its promise.

This guide will dig into all these elements—the tech, the partnerships, the legal drama, and the market history—to give you a well-rounded perspective. Once you understand both sides of the coin, you'll be in a much better position to decide if XRP has a place in your investment strategy.

Getting Your Head Around Ripple vs. XRP

First things first, let's clear up a massive point of confusion that trips up a lot of people. You’ll often hear the names "Ripple" and "XRP" thrown around as if they’re the same thing. They're not. Nailing down this difference is the absolute first step to figuring out what you’re actually investing in.

Here’s a simple way to think about it: Ripple is the company, and XRP is the product it created to power its network. It’s like Ford, the car company, and the Focus, one of the cars they make. You can buy the car, but that doesn't mean you own a piece of the company. Getting this right helps you separate the business from the digital asset.

Ripple is a privately-owned fintech company headquartered in San Francisco. It's been around since 2012, and its main goal has always been to shake up the ancient, slow, and expensive system we use for sending money around the world. To do this, they built a global payments network called RippleNet, specifically for banks, payment providers, and other big financial players.

So, Where Does XRP Fit In?

This is where the digital currency, XRP, enters the picture. Within Ripple's ecosystem, XRP was designed to be a "bridge currency". Its whole purpose is to make cross-border payments happen incredibly fast and for next to nothing, cutting out the chain of slow, fee-grabbing middlemen we currently rely on.

Let's say a bank in Dublin needs to send Euros to a partner in Japan who needs Japanese Yen. The old-school way involves a clunky process that can take days and rack up fees at every stop.

With Ripple’s tech, it’s a whole different story:

- The Dublin bank can convert Euros into XRP in a flash.

- That XRP zips across the XRP Ledger (the blockchain it runs on) in about 3-5 seconds.

- The bank in Japan gets the XRP and instantly flips it into Yen.

The entire thing is settled in less time than it takes to boil the kettle, and the cost is a tiny fraction of a penny. This is the core value Ripple is pitching to the financial world: speed and serious cost savings.

By acting as a neutral bridge asset, XRP gets rid of the need for banks to keep huge piles of foreign currency sitting in accounts all over the world (a costly practice known as maintaining nostro/vostro accounts). This frees up a massive amount of locked-up capital.

The Company vs. The Coin

To put it simply: Ripple is the company building the payment software. XRP is the independent digital asset that can be used on that software.

While Ripple did create the initial supply of 100 billion XRP tokens and still holds a large chunk of them, the XRP Ledger itself is decentralised and open-source. It isn't controlled by Ripple in the way a company would control its own private database.

This distinction is absolutely vital for investors. When you buy XRP on an exchange, you are not buying shares in Ripple, the company. You're buying the digital token. You're essentially betting that as more financial institutions adopt Ripple's technology, the demand for XRP will grow, which in turn will push up its price.

The success of Ripple (the company) and the value of XRP are obviously linked, but they are separate entities. Understanding this relationship helps you see the bigger picture. An investment in XRP isn't just a punt on another cryptocurrency; it's a calculated wager on a tech company's plan to disrupt a multi-trillion-pound industry.

How Ripple Is Used in the Real World

Talk is cheap in the tech world. The real question for any project is simple: does it actually solve a real problem for real people? For Ripple, this is the entire ball game. Its investment case isn't built on hype, but on its ability to do a specific job in the massive, clunky world of global finance.

For decades, international payments have been a headache. Stuck on the old SWIFT network, sending money across borders is often slow, expensive, and a complete black box. It can take days for a payment to clear, with hefty fees chipped away at each step. Ripple was built to fix this, offering a way to settle payments almost instantly.

This is where RippleNet, the company’s global payments network, comes in. Think of it as a club for banks, payment providers, and crypto exchanges, all connected to a system that lets them send money anywhere in the world, fast.

A Closer Look at On-Demand Liquidity

The killer app on RippleNet is a service called On-Demand Liquidity (ODL). This is where the XRP token gets its hands dirty. ODL uses XRP as a "bridge currency" to zip payments across borders without forcing banks to park huge sums of money in foreign accounts.

Let's break it down with a simple example:

- A bank in Dublin wants to send euros to a partner in Mexico who needs to receive pesos.

- With ODL, the bank converts the euros into XRP.

- That XRP flies across the network in just 3-5 seconds.

- The moment it arrives, the XRP is instantly converted into Mexican pesos and paid out.

This whole process sidesteps the multi-day waiting game of traditional banking. It frees up cash that would otherwise be stuck in transit, which is a huge deal for financial institutions.

ODL essentially creates "money motorways" where value can move as quickly as an email. By using XRP as a neutral go-between, it cuts out the friction and cost of swapping between dozens of different currencies.

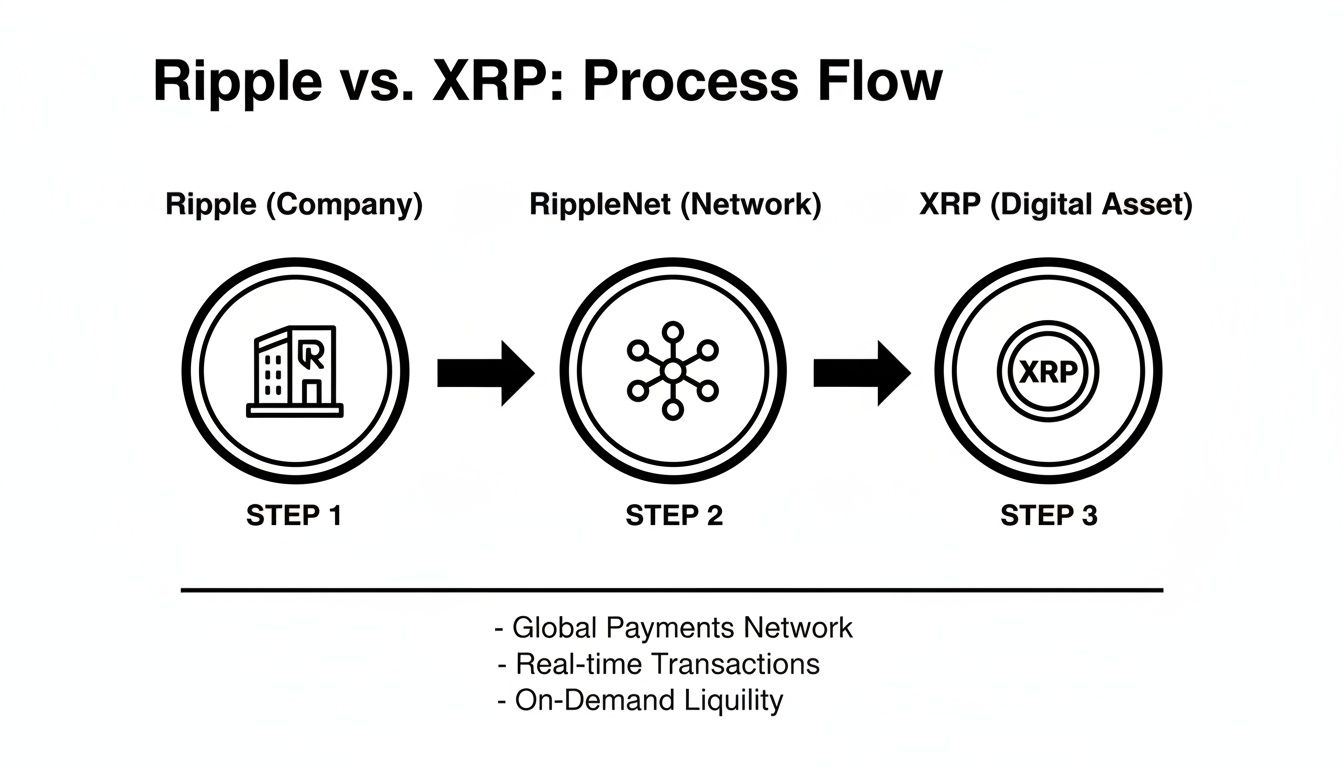

This diagram shows how it all fits together—from Ripple the company, to its RippleNet network, and the XRP asset that makes it all work.

You can see how Ripple's business plan is tied directly to the usefulness of its network and the XRP token itself.

Gaining Traction in Key Markets

Ripple has inked deals with hundreds of financial institutions worldwide, but it's making serious waves in the fast-growing Indo-Pacific region. This part of the world is a hotbed for payment innovation, and Ripple has carved out a solid niche.

Japan is a standout example. XRP has absolutely dominated crypto trading there, racking up an incredible £17.3 billion in trading against the Japanese Yen in the 12 months ending June 2025. For comparison, Bitcoin only saw £3.7 billion. This isn't random; it’s a direct result of Ripple’s partnership with Japanese financial giant SBI Holdings, which has promoted XRP as the asset of choice for modernising cross-border payments. It’s expected that nearly all Japanese banks will be using Ripple's XRP systems by the end of 2025.

But it’s not just about big banks. Ripple's tech is also being used to make everyday global remittances faster and cheaper. For instance, projects like Redotpay and Ripple for instant crypto transfers show how it can be applied to specific payment corridors, helping regular people, not just massive corporations.

Ultimately, the real-world adoption of ODL is the bedrock of any argument for XRP as a solid investment. Unlike many cryptocurrencies that are purely speculative bets, XRP has a clear job to do. The more banks and payment providers use RippleNet and ODL, the more demand there will be for the XRP token. That utility is what makes it different and forms the core of its potential long-term value.

Navigating the SEC Lawsuit and Regulatory Hurdles

You really can't get a clear picture of XRP as an investment without first tackling the elephant in the room: the long, dramatic legal battle with the U.S. Securities and Exchange Commission (SEC). For years, this single issue has cast a huge shadow over XRP, directly hitting its price, shaping market opinion, and making many financial institutions think twice about adopting it.

At its heart, the argument was simple, but its consequences were massive for the entire crypto industry. Back in December 2020, the SEC sued Ripple, claiming its sale of XRP tokens was an illegal, unregistered securities offering. The SEC’s position was that XRP should be treated like a stock. Ripple, on the other hand, fought back hard, insisting it was a digital currency, no different from Bitcoin or Ether.

This wasn't just a petty legal spat; it was a fundamental fight over what XRP is. The whole thing has been a real rollercoaster for investors, creating enormous risk and, for some, the potential for a huge reward if and when the smoke finally cleared.

The Core of the Conflict

The SEC's case was built on the idea that when people bought XRP, they were basically investing in a business (Ripple) and hoping to profit from the company's work. Ripple’s defence hinged on the argument that XRP is a piece of functional technology—a tool for payments—and its value comes from its utility, not just from people betting on Ripple's success.

This legal limbo is a big reason why many institutional players, especially in the US, have kept XRP at arm's length. The uncertainty simply made it too hot to handle for a corporate balance sheet.

The Ripple Effect: This lawsuit was about more than just XRP. It became a landmark case for the wider crypto world, as the final outcome could set a powerful precedent for how other digital assets are classified and regulated in the United States.

Landmark Rulings and a Glimmer of Clarity

The whole saga took a massive turn in July 2023 when a US judge handed Ripple a partial victory. The court decided that while Ripple's direct XRP sales to big institutional investors did count as securities sales, the XRP sold to everyday people on exchanges did not. This was a monumental win for Ripple and the XRP community, and the token's price shot up.

That ruling delivered a dose of legal clarity the market had been desperate for. The subsequent settlement between the U.S. SEC and Ripple in early 2025 cemented this, making XRP far more attractive, especially in IE markets. Take India, for example, which leads the IE region in crypto adoption. It saw an incredible £270 billion in on-chain transaction volume between July 2022 and June 2025. It just goes to show how grassroots enthusiasm and institutional interest can explode once regulatory clouds start to part.

This complicated legal backdrop really underscores how important it is to stay informed. These kinds of challenges aren't unique to crypto, either. If you're interested in the bigger picture, understanding the legal side of new tech is vital, which we cover in our guide on navigating the legal landscape of AI. For XRP, the remaining regulatory hurdles are a major risk factor that any potential investor must weigh up carefully.

What the XRP Ledger’s Data Is Telling Us

Price charts only give you a fraction of the picture. To really get a feel for what’s going on with XRP, you have to look at the activity happening directly on its network. This is what we call on-chain data, and it's like getting a direct health report, showing how people are actually using and holding XRP, away from all the market hype.

Looking at this data lets us cut through the noise and see the real strength and activity on the XRP Ledger. It drops hints about investor sentiment, adoption, and the network's overall momentum. Think of it like checking a company’s actual sales figures instead of just its share price—it’s a much more grounded way to size up its potential.

Reading Between the Lines of the Ledger

One of the most revealing things to watch is the flow of XRP moving on and off crypto exchanges. When you see big chunks of XRP moving off exchanges into private wallets, it’s usually a good sign. This pattern suggests people aren't looking to sell anytime soon. Instead, they're tucking their assets away for the long haul—a classic sign of accumulation.

On the flip side, a big spike in XRP flowing onto exchanges can mean holders are getting ready to sell, which often puts downward pressure on the price. Keeping an eye on these movements gives you a powerful glimpse into what the bigger players are thinking.

On-chain data is like a truth serum for the market. It bypasses opinions and shows you exactly what investors are doing with their money, giving you a clear window into supply, demand, and network activity.

A strong on-chain story for XRP has been building, particularly in the Indo-Pacific region, pointing to some serious investment potential. Data from the end of 2025 revealed that XRP balances on exchanges hit an all-time low after a massive 216 million tokens were pulled into private wallets. That’s a huge move, signalling widespread accumulation and a real boost in long-term confidence.

Taking the Pulse of Network Growth

Beyond just wallet movements, we can also check the pulse of the network itself. The two big metrics here are the number of active addresses and the daily transaction volume. A steady climb in active addresses means more people are actually using the network to send or receive XRP, which is a fundamental sign of adoption.

Likewise, rising transaction volume shows that the network is doing what it was designed to do—move value efficiently. While the price might jump all over the place, these core metrics tell you if the XRP Ledger's utility is genuinely growing. It’s one of the clearest ways to tell if XRP is gaining real traction beyond just being a speculative asset. Insights from AI-driven data analytics are also becoming essential for making sense of these complex data sets and spotting trends that matter.

Let's look at a snapshot of the network's health from early 2025. The table below highlights a few key metrics that paint a picture of steady growth and engagement.

XRP Network Health Indicators

| Metric | Statistic | Indication |

|---|---|---|

| Active Addresses (24h) | 285,000+ | A growing base of daily users sending or receiving XRP. |

| Daily Transactions | 1.2 Million | Consistent and high transaction throughput. |

| New Accounts Created | ~4,500 Daily | Steady network expansion and new user adoption. |

| Exchange Outflow (30d) | 150 Million XRP | Strong accumulation signal; investors moving to long-term storage. |

These numbers aren't just abstract figures; they reflect a living, breathing network with increasing utility. The consistent creation of new accounts paired with significant outflows from exchanges points to both new interest and deepening conviction from existing holders.

Keeping an Eye on the Big Money

Institutional money is often seen as a seal of approval for a digital asset. For XRP, we can track this by watching the inflows into investment products like Exchange-Traded Funds (ETFs). When serious capital starts pouring into these products, it’s a clear signal that large, sophisticated investors are getting comfortable with the asset's future.

This trend really kicked off after the SEC settlement. Almost immediately, XRP ETFs pulled in an impressive £710 million in inflows. What made this stand out was that it happened while Bitcoin and Ethereum products were actually seeing outflows. It shows that regulatory clarity was the final green light for many big players who had been waiting on the sidelines.

To get a better handle on these market dynamics, it's worth exploring the broader field of on-chain analysis. By piecing together exchange flows, user activity, and institutional investment, you get a much richer, evidence-based view of where XRP might be heading.

So, Should You Invest in Ripple? Here's How to Decide

We’ve pulled apart the tech, looked at its real-world applications, and waded through the high-stakes regulatory drama. What’s the final verdict? Well, figuring out if Ripple is a good investment isn’t about a simple 'yes' or 'no'. It's a decision that has to be rooted in your own financial situation, what you’re trying to achieve, and frankly, how much risk you can stomach.

Let’s be clear: XRP isn’t a slow-and-steady, traditional asset. It’s a high-risk, high-reward play on a very specific vision for the future of finance. When you buy XRP, you’re essentially betting that Ripple's technology will become a cornerstone of the global payments system. That’s a huge undertaking, and it comes with massive challenges and some very powerful competitors.

Your Personal Due Diligence Checklist

Instead of giving you financial advice, I want to give you the right questions to ask yourself. Before you even think about investing, run through this checklist. It’s all about making sure this kind of move actually fits your strategy.

-

How Much Risk Can I Handle? Be brutally honest with yourself. If the money you invest disappeared tomorrow, would you be okay? The crypto market is famous for its volatility, and XRP is right in the thick of it. Its price can swing dramatically on the back of a single piece of news or a shift in market sentiment.

-

Do I Actually Get It? Could you explain what Ripple does and the problem XRP solves to a friend in a couple of sentences? Never, ever invest in something you don't truly understand. When the market inevitably takes a dive, your understanding is what will give you the conviction to hold on (or the clarity to get out).

-

What’s My Timeframe? Are you trying to make a quick buck, or are you in this for the long haul? Ripple's mission to rewire global finance is a marathon, not a sprint. To really see this vision come to life, you’re probably looking at a timeline of several years, not weeks or months.

Building a Smart Portfolio

No single asset should ever be your entire investment strategy. That’s just asking for trouble. A sensible approach is all about diversification—spreading your money across different asset types to keep your risk in check. For almost everyone, a high-risk asset like XRP should only ever be a small slice of their overall portfolio.

Think of it like putting together a sports team. You need your reliable defenders (your stocks, bonds, and steadier investments) and maybe one or two high-impact strikers who have the potential to score big but come with more risk. XRP is definitely a striker. This is especially critical when markets get choppy; you can learn more about protecting and understanding your cash flow during times of uncertainty in our deep-dive guide.

The Bottom Line: Deciding on Ripple boils down to a blend of belief and caution. Do you genuinely believe in its mission to fix cross-border payments? And have you balanced that potential against the very real risks involved?

Ultimately, the decision is yours. Stay on top of the news, keep a close eye on Ripple’s partnerships and any regulatory updates, and always make sure your investment choices line up with your personal financial goals. If you approach it with a clear head and a solid grasp of what you’re getting into, you can make a decision that feels right for you.

Got Questions About XRP? We've Got Answers.

Alright, let's wrap this up by hitting on some of the big questions that always seem to pop up when people are weighing an investment in XRP. These are the things that might be nagging at you, so let's get you some straight answers.

How is XRP Actually Different from Bitcoin?

Yes, and in some really fundamental ways. It's best to think of them as being built for completely different jobs. Bitcoin was designed to be a decentralised digital cash—a way for people to send money to each other without a bank and, for many, a store of value like digital gold.

XRP, on the other hand, was built with a laser focus on one thing: helping banks and financial institutions move money across borders quickly and cheaply. It’s meant to be a "bridge currency" to make international payments less of a headache.

The tech under the hood is worlds apart, too:

- How transactions are approved: Bitcoin uses Proof-of-Work, which you probably know as mining. It’s slow and uses a ton of energy. XRP uses a consensus method where a small group of trusted validators confirm transactions in just a few seconds.

- How they were created: New bitcoins are "mined" into existence and will continue to be until the max supply is reached. With XRP, the entire supply of 100 billion tokens was created all at once back in 2012.

- The company connection: Bitcoin is the brainchild of the anonymous Satoshi Nakamoto and has no central company running the show. XRP was created by developers who then gifted a massive chunk of the tokens to a company, Ripple, which now promotes its use.

Why is Ripple Sitting on a Mountain of XRP?

This is a really important question, and frankly, it's one of the most debated topics in the crypto community. When the XRP Ledger was first launched, its creators gave 80 billion of the total 100 billion XRP to the company we now know as Ripple.

The official line is that Ripple uses these funds to run the company, strike deals with partners, and generally grow the ecosystem around its payment network, RippleNet.

To calm market fears of them dumping it all at once, Ripple locked most of its XRP holdings in a cryptographically-secured escrow. This escrow releases a certain amount every month, and anything Ripple doesn't use gets put back. While it adds a bit of predictability, it also means Ripple has a huge say over the token's supply—a centralisation risk that definitely gives many investors pause.

What's the Safest Way to Buy XRP?

For most people, the easiest and most common way to get your hands on XRP is through a well-known cryptocurrency exchange. The key here is choosing a platform that is secure and properly regulated; you don't want to cut corners when your money is on the line.

A quick word of advice: always do your homework before signing up with an exchange. Look for ones that have strong security features like two-factor authentication (2FA), have been around for a while, and have positive feedback from other users. Once you've bought your XRP, seriously consider moving it off the exchange and into a private wallet you control. That way, you truly own it.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.