Trying to manage your startup’s finances can feel like you're piecing together a massive jigsaw puzzle, but half the pieces are missing. This is where solid accounting and bookkeeping software comes in. It's the tool that finds those missing pieces and puts them all together, creating a clear picture of your financial health.

Think of it as the command centre for your money, right from the very beginning. The right software handles the day-to-day grunt work of keeping records and also gives you the big-picture insights you need to grow your business.

Setting Up Your Startup's Financial Hub

For a lot of founders, the words "bookkeeping" and "accounting" get thrown around as if they're the same thing. They're not. Nailing the difference is key to building a business that's financially solid. Let's break it down with a simple analogy.

Imagine you've just opened a buzzing coffee shop in Dublin. Bookkeeping is the daily grind of recording every single transaction. It’s logging the sale of each flat white, the cost of the milk delivery from the local dairy, and the wages you pay your baristas. This creates a detailed, running list of every cent that comes in and goes out. It’s the raw data, the foundation of your financial story.

Accounting, on the other hand, is what you do with that story. It’s taking a step back to figure out your profit margins on croissants versus Americanos. It’s using those daily records to predict your cash flow for the next three months, file your VAT returns with Revenue, and make the big call on whether opening a second shop is a smart move.

How Modern Software Changes the Game

This is precisely where good software becomes a founder's best friend. It automates the tedious, mind-numbing tasks of bookkeeping, like sorting expenses and matching up bank transactions. This doesn't just save you a mountain of time; it also slashes the risk of human error, meaning your financial records are clean and reliable.

By taking care of the daily nitty-gritty, the software frees you up to focus on the accounting—the strategic thinking that actually fuels your growth. Instead of being buried in a pile of receipts, you can pull up a profit and loss statement with a click.

For a startup, picking the right software isn't just about admin. It's one of the first, and most critical, strategic calls you'll make. It sets the stage for financial clarity, investor confidence, and smart scaling.

Why This Is Crucial for Irish Startups

Getting this sorted from day one is especially vital for start-ups in Ireland. Proper financial tracking ensures you stay on the right side of local regulations from bodies like Revenue and helps you manage your money effectively. Plus, when it's time to seek investment or apply for a loan, having squeaky-clean financial records is completely non-negotiable.

You can learn more by exploring how to protect and understand your cash flow, a must-have skill for any founder trying to navigate the inevitable ups and downs.

Ultimately, the right software gives you a live, honest look at your company's financial health. It's the tool that lets you stop guessing and start making decisions with real confidence.

The Core Features Your Business Can't Live Without

When you first dip your toe into the world of accounting and bookkeeping software, the endless feature lists can feel a bit much. Every sales page is a blizzard of jargon, but what do you actually need to run your startup day-to-day? Let's cut through the noise and get straight to the tools that will genuinely save you time, kill the stress, and give you a crystal-clear view of your financial health.

Think of these as the non-negotiable parts of your financial engine. Without them, you’re stuck pushing your business uphill, bogged down by manual spreadsheets and pure guesswork.

Automating Your Invoicing and Payments

Getting paid is priority number one, right? But chasing invoices is a soul-crushing time-suck for any founder. Good software transforms this tedious chore into a slick, automated process. You can whip up and send professional-looking invoices in minutes, schedule automatic reminders for those clients who are a bit slow to pay, and even let them pay you instantly through integrations like Stripe or PayPal.

For a new Dublin-based creative agency, this means less time buried in admin and more time doing brilliant client work. The system handles the payment tracking, giving their cash flow a much-needed boost.

Keeping a Live Eye on Your Cash

One of the most powerful features you’ll find is the live bank feed. It securely links up with your business bank account and automatically imports every single transaction. Say goodbye to the soul-destroying task of manually typing in every coffee receipt or bank transfer.

This gives you a real-time, dead-accurate picture of your cash position. You can see exactly what's coming in and what’s going out, right now, without having to wait for a month-end report. That kind of instant insight is gold when you need to make smart, timely calls on spending or investment.

Managing Expenses Without the Hassle

You know that shoebox overflowing with crumpled receipts? It's time to kick it to the kerb. Modern accounting software makes it history. With mobile expense tracking, you just snap a photo of a receipt on your phone, and clever tech pulls out the key info—vendor, date, and amount.

This isn't just about making life easier; it's about keeping your books accurate and staying on the right side of Revenue. Capturing expenses as they happen ensures you claim every single cent you're entitled to and have a clean, digital paper trail ready if they ever come knocking.

The move to these tools is already making a real difference. By 2022, an estimated 63% of Irish SMEs had made the switch to cloud accounting software. These businesses reported saving 3–6 hours per week on their bookkeeping alone, which quickly adds up to thousands of euros in savings each year.

Generating Reports That Actually Mean Something

All the data in the world is useless if you can't make sense of it. Your software should let you generate crucial financial reports with just a couple of clicks. For any start-up, these are the two you absolutely need to watch:

- Profit & Loss (P&L) Statement: This is your business’s report card. It shows you, plain and simple, whether you're making or losing money over a certain period.

- Balance Sheet: This gives you a snapshot of your company's financial health on a specific day, laying out what you own (assets) and what you owe (liabilities).

These reports are essential for tracking how you’re doing against your goals. If you need a quick refresher on what to measure, our guide on what KPIs are and how to use them can help you get started.

Looking ahead, artificial intelligence is set to change the game even further. The next wave of tools promises even more efficiency. To get a glimpse of what's on the horizon, it’s worth reading up on the impact of AI in accounting automation. This tech is poised to handle even more of the routine stuff, freeing you up to focus on the big picture.

Let's break down the must-have features in a simple table to see what they do and why they matter for a growing Irish business like yours.

Essential Software Features for Irish Start-ups

| Feature | What It Does | Why Your Start-up Needs It |

|---|---|---|

| Automated Invoicing | Creates, sends, and tracks professional invoices with payment links. | Gets you paid faster and frees up your time from chasing late payments. |

| Live Bank Feeds | Automatically imports all your bank transactions in real time. | Gives you an up-to-the-minute, accurate view of your cash flow for better decisions. |

| Mobile Expense Tracking | Lets you capture receipts with your phone's camera, extracting key data. | Ensures you claim all eligible expenses and maintain a perfect digital record for Revenue. |

| VAT/Tax Management | Calculates and helps you prepare VAT returns based on your data. | Takes the headache out of tax compliance and reduces the risk of costly errors. |

| Financial Reporting | Generates key reports like Profit & Loss and Balance Sheets in one click. | Helps you understand your performance, track against goals, and report to investors. |

| Multi-Currency Support | Manages transactions and invoices in different currencies automatically. | Crucial for any business dealing with international clients or suppliers. |

Ultimately, choosing software with these core features isn't just an expense—it's an investment in efficiency, accuracy, and your own sanity. They provide the solid foundation you need to manage your finances confidently as your startup grows.

Choosing Software That Grows with You

The simple, free accounting tool that handles your first few invoices perfectly can quickly become a digital straitjacket once your business starts to really take off. Picking the right accounting and bookkeeping software isn’t just about sorting out today’s finances; it's a strategic bet on where you’re headed. The last thing you want is for your financial system to turn into a bottleneck that kills your momentum.

For a brand-new start-up, the priorities are crystal clear: you need something affordable, simple to use, and that keeps you on the right side of Revenue. You don't need a system with a thousand bells and whistles you'll never touch. The goal is to build good financial habits from day one without overcomplicating things.

But as your start-up gains traction, your needs will inevitably get more complex. What worked for a two-person operation will need to evolve to support your ambition.

From Early Days to Growth Stage

In the beginning, it’s all about getting paid and tracking what you spend. Simple. But as you scale, a whole new world of financial challenges and opportunities opens up. Your software needs to be ready to grow with you, handling more complex tasks without creaking at the seams.

This is where you start looking beyond the basics. Think about what your business might look like in one, two, or even five years.

- Selling Abroad? If you’ve got your eye on customers outside of Ireland, multi-currency support is non-negotiable. This feature takes the headache out of international invoicing and payments by handling exchange rates automatically.

- Hiring Your First Team Members? The moment you bring on your first employee, integrated payroll becomes essential. It helps you manage salaries, PAYE, and PRSI contributions, making sure you stay compliant with Irish employment law.

- Seeking Investment? VCs and angel investors will want to see detailed financial reports. Your software must be able to generate sophisticated reporting—think cash flow forecasts and departmental budgets—to give them the confidence to write a cheque.

- Building Your Tech Stack? Your accounting software shouldn't be a lonely island. Look for strong integrations with the other tools you rely on, like your CRM (Salesforce) or e-commerce platform (Shopify), to create a seamless flow of data across the business.

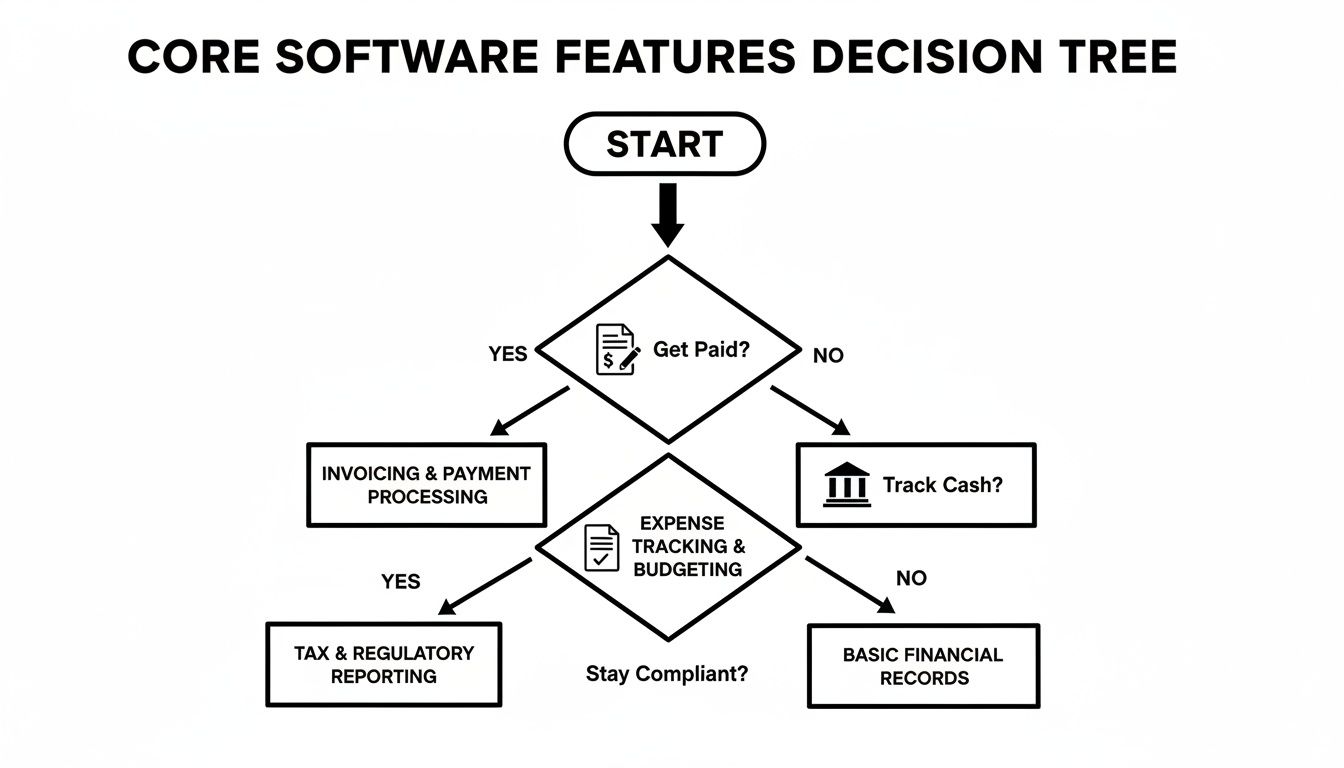

This decision tree gives you a visual on the core questions a founder needs to answer when figuring out what features they need from the get-go.

As the flowchart shows, it really all boils down to three fundamentals for any start-up: invoicing, tracking cash, and staying compliant.

The True Cost of Outgrowing Your Software

Let’s be honest, switching your financial system is a massive pain. It’s a disruptive and expensive process that involves migrating years of sensitive data, retraining your team, and rebuilding all your financial workflows from the ground up. Choosing a scalable solution from the start helps you avoid all that.

Think of it like building a house. You wouldn't lay a foundation for a garden shed if you plan on eventually building a two-storey home. The same logic applies to your financial infrastructure. A scalable system provides a solid foundation that can support your growth indefinitely.

This forward-thinking approach is absolutely crucial. You need a partner that can handle a growing number of transactions, more users, and more complex reporting as your company expands. The right accounting and bookkeeping software isn't just a tool for today; it's a critical piece of infrastructure for your future success.

Navigating Irish Compliance and Data Security

If you're running a business in Ireland, keeping Revenue happy isn't just a good idea—it's absolutely critical. Choosing the right accounting and bookkeeping software is about more than just making your life easier. It’s your first line of defence, helping you handle local compliance with total confidence.

Let’s tackle the big one first: payroll. As soon as you hire someone, you’re thrown into the world of PAYE Modernisation. This means you have to report to Revenue in real-time, every single time you pay your staff. This is where software with a solid payroll function becomes your best friend. It crunches the numbers for PAYE, PRSI, and USC automatically and sends the report straight to Revenue for you.

Suddenly, a fiddly, stressful task becomes a background process. The risk of manual errors disappears, along with the threat of fines for late filing.

Taking the Headache Out of VAT

Next on the list is Value Added Tax (VAT). Anyone who's handled it knows what a pain it can be. You’re juggling different rates for various products and services, all while staring down strict filing deadlines. Trying to track every transaction by hand is a recipe for mistakes and wasted hours.

Modern accounting software simply takes care of it. It tracks the VAT on everything you buy and sell, puts together all the information needed for your return, and often links directly with the Revenue Online Service (ROS) to file it for you. This frees up a huge amount of admin time and lets you breathe easy, knowing your numbers are spot on.

The move to digital isn't just a trend anymore; it's the standard. The right software doesn't just help you keep pace—it puts you ahead by freeing up countless hours you can reinvest into actually growing your business.

The proof is in the numbers. Between 2018 and 2024, Irish businesses jumped on board with cloud accounting. By 2023, around 70% of VAT-registered businesses were filing online, a shift driven by software that automates the whole thing. The businesses that made the switch saw their invoice-to-cash cycles speed up by 5–12 days and slashed the time spent on manual VAT prep by 40–60%. To get a broader view, you can dig into more data on the accounting software market's growth.

Protecting Your Data and Staying GDPR-Compliant

Of course, compliance is about more than just taxes. We live in a world of data, and protecting your financial and customer information is non-negotiable. For any business in Ireland, that means being fully compliant with the General Data Protection Regulation (GDPR) when you handle personal data. Keeping proper records is a huge part of this, and this guide to building an actionable GDPR register is a great external resource to help you get it right.

When you're looking at software, you have to get serious about its security features. Your financial data is a goldmine for criminals, so your provider’s security needs to be rock-solid. Here’s what to look for:

- Data Encryption: Your information should be scrambled and unreadable to unauthorised eyes, both when it's sitting on a server and when it's being sent.

- Secure Cloud Hosting: Check that the provider uses a reputable, secure cloud service. These platforms have top-tier protection against both digital and physical threats.

- Access Controls: You need to be able to decide who sees what. Good software lets you set permission levels, so team members only access the information they need to do their jobs.

- Regular Backups: Your data should be backed up automatically and frequently. The last thing you want is to lose years of financial history because of a glitch.

Protecting data isn't just about avoiding fines; it’s fundamental to earning and keeping your customers' trust. With threats constantly evolving, it's also smart to understand how new tech is fighting back. You can learn more about this in our article on combating financial fraud with AI. By picking software that takes security seriously, you’re building a strong, resilient foundation for your start-up’s finances.

Understanding the True Cost of Your Software

Let's talk money. When you start comparing accounting and bookkeeping software, it’s all too easy to focus on that big, bold monthly price. But the real cost of these tools is rarely captured in that headline number.

This isn’t just about finding the cheapest option on the market. It’s about understanding what you’re actually getting for your money. Think about it: a platform that costs a little more but saves your team five hours of soul-crushing admin every week? That's not an expense; it's a stellar investment. On the flip side, a cheap tool that causes constant headaches and requires manual workarounds is a classic false economy.

Decoding Common Pricing Models

As you start window shopping, you’ll run into a few common ways companies structure their pricing. Getting a handle on these models is key to comparing your options fairly and, more importantly, avoiding any nasty surprises on your first invoice.

The vast majority of modern software runs on a monthly subscription model. You pay a recurring fee, which is great for keeping your cash flow predictable without a massive upfront cost. These plans are almost always tiered – the more you pay, the more features and users you unlock.

Here's a quick look at what you'll typically find:

- Per-User Fees: Simple enough. You pay based on how many people on your team need access. This can be perfect for a solo founder but watch out, as the costs can climb quickly as you hire.

- Tiered Feature Plans: This is the most common approach. A basic plan might give you invoicing and expense tracking, while a premium tier throws in payroll, multi-currency support, and much deeper reporting.

- Transactional Fees: Less common for the core software, but some platforms will take a small cut of certain transactions, like when you process a customer payment through their integrated gateway.

Uncovering the Hidden Costs

The sticker price is just the starting point. To build a proper budget, you need to dig a little deeper and sniff out the other costs that can sneak up on you. They aren't always obvious, but they can definitely impact your total spend.

Keep an eye out for these extras:

- Setup or Implementation Fees: More advanced systems sometimes charge a one-off fee to get everything configured and to help you migrate your data over.

- Premium Support: Basic email or chat support is usually free, but if you want to jump the queue or get a dedicated account manager on the phone, that’ll often cost extra.

- Add-On Modules: Need something specific like payroll or advanced inventory management? These are frequently sold as separate modules that plug into your core subscription.

The real goal is to find a tool that fits your budget today and tomorrow. It's about understanding the total cost of ownership as your start-up grows. A cheap plan might look great now, but if you have to bolt on critical add-ons later, it could easily become the more expensive choice in the long run.

In Ireland, the market has a pretty clear pattern. For most small and medium businesses, cloud-based software is king, with subscriptions typically landing somewhere between €10–€50 per user each month, depending on the features you need. Add-ons for things like payroll and e-invoicing are very common, helping businesses stay compliant with Irish regulations like PAYE Modernisation. You can dig into these trends in more detail with these market insights on Irish accounting software.

How to Evaluate True Value

So, how do you really know if something is worth the price? Get your hands dirty with a free trial.

Seriously, don’t just click around the dashboard for five minutes. Use the trial to run real-world scenarios. Send a few test invoices, connect a bank account, and try to pull a profit and loss report. This is the only way you'll know for sure if a platform actually works for your business and is a worthwhile investment in your company’s future.

Making a Smooth Transition to Your New System

So, you've done the hard yards. You’ve weighed your options, read the reviews, and finally picked the right accounting and bookkeeping software for your startup. Now for the part that makes most founders nervous: actually getting it up and running without breaking anything.

But let's be clear, moving on from spreadsheets or a clunky old system doesn't have to be a nightmare.

Think of it less like a massive IT project and more like moving house. A bit of planning and packing beforehand makes the actual move day a whole lot smoother. It all comes down to a solid plan, setting up the new system properly, and getting your team excited about it from the get-go.

Your Pre-Migration Checklist

Before you even think about moving a single byte of data, you need to get your current financial house in order. This is the “tidy up before the movers arrive” phase, and honestly, it’s the most critical step for a stress-free migration. A clean start means you won't be carrying old mistakes over to your shiny new system.

Here’s what you absolutely must do:

- Tidy Your Data: Get forensic. Reconcile every bank account, chase down any unpaid invoices, and double-check that your customer and supplier details are actually correct and up to date.

- Set an Opening Balance Date: Pick a sensible cut-off point, like the start of a new quarter or, even better, the beginning of your financial year. This date becomes your "day one" in the new software, keeping your financial reports clean and logical.

- Export Your Records: Pull all the crucial info out of your old system. We're talking about your chart of accounts, customer and supplier lists, and any outstanding invoices or bills. Most systems will let you export this data as simple CSV files.

Setting Up for Success

Once your data is clean and ready, the setup process is surprisingly straightforward. This is where you mould the software to fit your business perfectly, not the other way around. Kick things off by importing the customer and supplier lists you just prepped.

Next up, connect your business bank accounts. This is a game-changer. Setting up live bank feeds will automate a massive part of your future bookkeeping. While you're at it, take a few minutes to personalise your invoice templates with your logo and payment terms to keep things looking professional.

This is the perfect time to bring your accountant into the loop. Get them to look over your setup. They’ll make sure your chart of accounts is structured correctly for Irish tax obligations and can spot potential issues that could save you a fortune down the road.

Finally, set aside proper time to train your team. Even the most user-friendly software has a learning curve. A quick session showing them how to do their specific tasks—like raising an invoice or logging an expense—makes sure everyone feels confident and uses the system correctly from day one. That little bit of time spent on training will pay for itself again and again in fewer errors and better efficiency.

Frequently Asked Questions

Stepping into the world of accounting and bookkeeping software can feel a bit like learning a new language. To help you get your bearings, here are some straight answers to the questions we hear most often from founders in Ireland.

Can I Do My Own Bookkeeping with Software?

Yes, you absolutely can. Modern software is designed with non-accountants in mind, making it easy for founders to handle day-to-day tasks like sending invoices and logging expenses. In the early days, when you’re watching every euro, doing it yourself is a smart, cost-effective move.

But this doesn’t mean your accountant is out of a job. Far from it. Their role just shifts from tedious data entry to high-value strategic advice. They’re the ones who can look at the data your software has collected and tell you what it actually means for your business, manage your Corporation Tax, and guide your growth strategy.

Think of it this way: the software handles the what—recording the daily numbers. Your accountant explains the why—what those numbers signal about the health and future of your start-up.

This approach gives you the best of both worlds. You get the speed and efficiency of great software, paired with the irreplaceable wisdom of an experienced financial expert.

How Long Does It Take to Switch Systems?

That really depends on your starting point. If you're a brand-new start-up without any financial history to bring over, you can honestly be up and running in a couple of hours.

For a more established business moving from messy spreadsheets or an old-school system, the timeline is a bit longer. You should probably set aside anywhere from a few days to a couple of weeks to get everything transferred and working perfectly.

The biggest variable here is preparation. If you put in the work upfront to clean up and organise your existing financial data, the migration itself will be a whole lot quicker and a lot less painful.

What Is the Most Important Software Integration?

For pretty much any business in Ireland, the hands-down most critical integration is a live bank feed. This feature automatically pulls transaction data straight from your business bank account into your software. It saves an incredible amount of time on manual entry and dramatically cuts down on human error.

The next must-have is a solid connection to the Revenue Online Service (ROS). This takes the headache out of compliance by automating your VAT and PAYE submissions, ensuring you meet your obligations without the stress.

Once you have those two covered, the right integrations depend entirely on how your business operates. For instance:

- Payment Gateways: If you take payments online, a direct link to a service like Stripe is a no-brainer for smooth cash flow.

- E-commerce Platforms: For businesses selling goods online, an integration with a platform like Shopify is essential to make sure your sales records are always accurate.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.