You've probably heard the names thrown around in business news or discussions about the stock market: Deloitte, PwC, EY, and KPMG. Together, they're known as the Big Four, and they're not just accounting firms; they're global powerhouses in the professional services world. They audit the vast majority of public companies and provide essential tax and advisory services that keep the wheels of the global economy turning.

Who Are the Big Four Accounting Firms?

Whenever a major corporation releases its financial results, there’s a good chance one of the Big Four was working behind the scenes to verify those numbers. Think of them as the ultimate referees in the game of international business. Their job is to make sure companies are playing by the rules and reporting their finances accurately, which builds the trust that our entire financial system relies on.

But their influence goes way beyond just checking the books. These firms are massive, multifaceted organisations that shape business practices and even influence financial regulations around the world. They're much more than simple number-crunchers.

Core Functions and Market Dominance

At their core, the Big Four offer three main services to a client list that includes everyone from Fortune 500 giants to governments and major non-profits.

- Audit and Assurance: This is their bread and butter. They act as independent inspectors, verifying that a company's financial statements are a true and fair reflection of its performance. This gives investors, regulators, and the public confidence in the information they're seeing.

- Tax Services: They guide multinational corporations through the incredibly complex maze of global tax laws. It's about ensuring compliance whilst also helping companies structure themselves in a tax-efficient way.

- Advisory and Consulting: This has become a huge area of growth. It covers everything from strategic advice on mergers and acquisitions to cybersecurity, risk management, and helping businesses adapt to new technology.

Their grip on the market is undeniable. Just look at Ireland, where in 2022, the Big Four audited a staggering 96% of the country's Public Interest Entities (PIEs)—which includes major banks, insurance companies, and other listed corporations. If you're curious about the global audit landscape, you can find more insights on Statista.com.

Why Their Work Matters

The stability of our economy really does hang on the integrity of the work these firms do. Their audits provide the crucial layer of assurance that allows investors to put their capital into businesses with confidence. Without that trusted third-party verification, investing would be a much riskier business, and the flow of money that fuels economic growth would slow right down.

Their role extends beyond simple compliance; it's about building and maintaining trust in the entire financial ecosystem. When a Big Four firm signs off on an audit, it lends a powerful stamp of credibility that is recognised globally.

To put it simply, understanding the Big Four is essential for anyone in business, finance, or investing. They are fundamental pillars of modern commerce, and their work has a quiet but massive impact on everything from stock prices to the big decisions made in boardrooms everywhere.

Meet the Titans: A Profile of Each Firm

Whilst they all fly the "Big Four" flag, it's a rookie mistake to think these firms are all the same. Each has spent decades carving out its own identity, strategic focus, and areas where it truly dominates. Getting a handle on these subtle but crucial differences is key for any business, investor, or ambitious professional looking to work with them.

So, let's pull back the curtain on Deloitte, PwC, EY, and KPMG to see what really makes them tick. We'll dig into their core strengths, who they work with, and the unique flavour each brings to the table.

Deloitte: The Consulting Powerhouse

By sheer size and revenue, Deloitte often feels like the undisputed heavyweight champion of the group. It consistently posts eye-watering global earnings, and whilst its audit and tax arms are massive in their own right, its reputation is undeniably forged in the fires of its consulting practice. It's a behemoth, employing a staggering 457,000 people in over 150 countries.

Think of Deloitte as the go-to crew for huge, complex business transformations. They're the ones Fortune 500 companies call when they need to overhaul their entire digital strategy, untangle a global supply chain, or rethink their approach to talent. They thrive on massive projects that can reshape how entire industries function.

- Key Strength: Strategy and management consulting.

- Best For: Massive companies staring down the barrel of a major operational or technological shift.

- Cultural Vibe: Often described as entrepreneurial and relentlessly fast-paced, with a laser focus on growth and performance.

PwC: The Gold Standard in Audit

PricewaterhouseCoopers, or PwC as everyone calls it, carries an unmistakable air of tradition and prestige, especially in the world of audit and assurance. For many in the business world, a PwC-signed audit report is the gold standard of financial credibility—a reputation built over more than a century of painstaking work. They're the firm trusted by some of the world's most iconic brands, like Hershey's and Hyatt, to sign off on their books.

Whilst PwC has a strong and expanding advisory practice, its identity is still deeply rooted in that audit legacy. The firm is known for its meticulous, almost obsessive attention to detail and deep industry knowledge, making it a natural choice for publicly-listed companies under the intense glare of regulatory scrutiny. That focus on trust is the bedrock of their entire brand.

Their global influence is growing, particularly in emerging economies. For instance, the Big Four's presence in India has exploded. In the 2023 fiscal year, the firms collectively snapped up over 45% of India's organised audit and consulting market. You can dig deeper into the data on the Big Four's market expansion in India on Wiley Online Library.

EY: The Champion of Growth

Ernst & Young, now just EY, has cleverly carved out a unique space for itself by championing entrepreneurship and fast-growing companies. Sure, it serves global giants like the rest, but EY is perhaps best known for its "Entrepreneur of the Year" awards, a global programme that celebrates and connects the world’s most ambitious business leaders.

This focus gives EY a distinctly different energy. They often come across as more forward-looking and innovative, especially when it comes to technology and transaction advisory. EY has been pouring money into areas like AI, positioning itself to support the next generation of market-disrupting companies.

EY's entire strategy is often neatly captured by its tagline, "Building a better working world." It’s more than just a marketing slogan; it points to their commitment to helping both scrappy start-ups and established players navigate change and find sustainable growth.

- Key Strength: Services for entrepreneurs, scale-ups, and transaction advisory.

- Best For: Ambitious start-ups with IPO dreams, companies in the middle of a merger or acquisition, or any business hitting a rapid growth spurt.

- Cultural Vibe: Tends to be seen as collaborative and people-centric, with a big emphasis on learning and professional development.

KPMG: The Guardian of Risk and Regulation

In a world filled with ever-more-complex financial rules and compliance headaches, KPMG has built its reputation on being the expert in risk management and regulation. They've positioned themselves as the firm you call to help you navigate the rulebook and stay out of trouble.

Their auditors and advisers are specialists, with deep knowledge of heavily regulated sectors like banking, insurance, and government. If a company is facing a thorny compliance issue or needs to build a rock-solid internal controls system from scratch, KPMG is usually at the top of the call list.

This specialisation makes them an essential partner for any organisation where public trust and ethical conduct are non-negotiable. They've also been very public about their commitment to weaving environmental, social, and governance (ESG) principles into business strategy, which fits perfectly with their focus on sustainable, responsible operations.

So, What Do They Actually Do? The Core Services

You hear about the Big Four everywhere, but what do these global giants really do day in and day out? Whilst their expertise is incredibly broad, their work generally boils down to three main pillars: Audit & Assurance, Tax, and Advisory.

Think of these not as separate departments, but as interconnected engines that drive modern business. Each one is a multi-billion pound operation in its own right, and understanding them is the key to seeing just how much influence these firms have on the global economy.

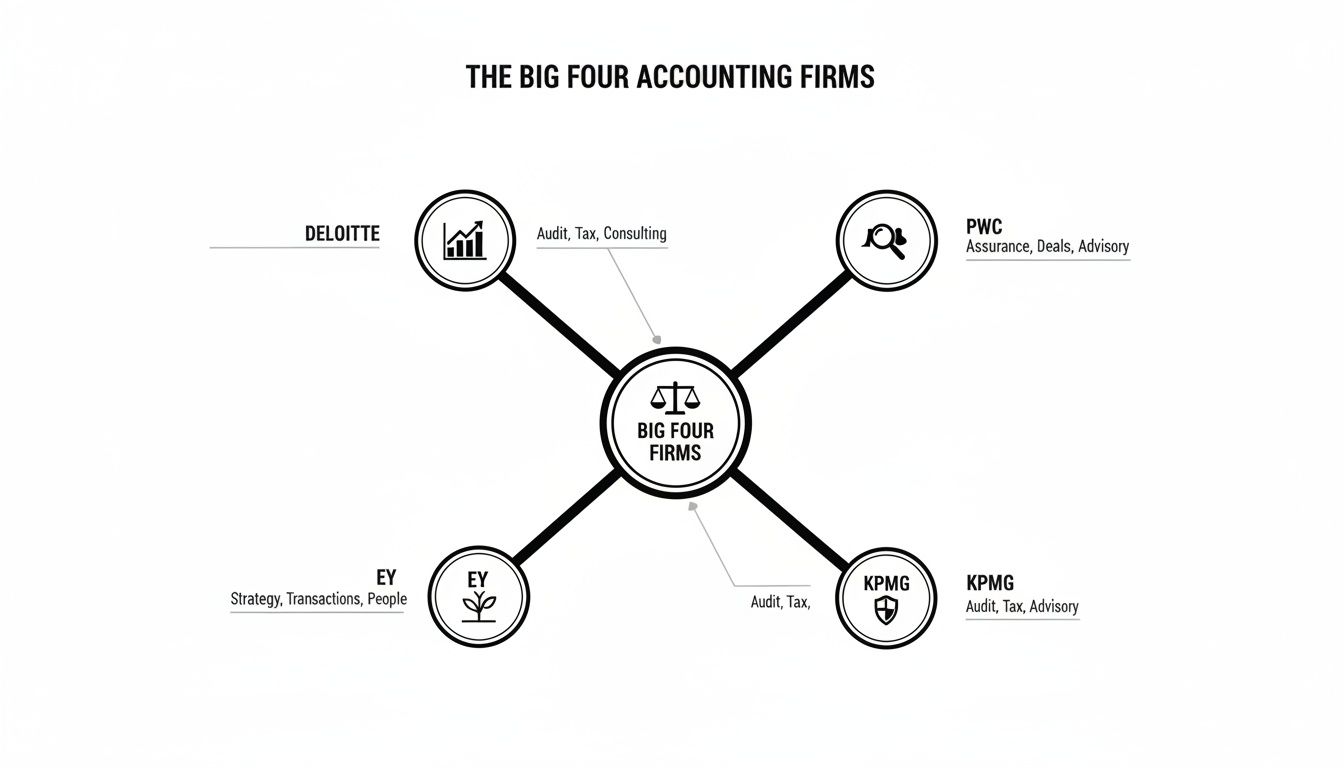

This diagram gives you a bird's-eye view, showing how each firm, whilst covering all bases, has carved out its own unique reputation.

As you can see, Deloitte is a consulting powerhouse, whilst KPMG is known for its laser focus on risk. But they all started with the same fundamental service: the audit.

Audit and Assurance: The Financial Health Check

At its core, an audit is like a doctor's full physical for a company's finances. It's the original service that built these empires, and it's still the bedrock of their entire operation.

An audit team pores over a company's financial statements, internal controls, and bookkeeping. Their mission? To give an independent opinion on whether the numbers are accurate and paint a true picture of the company's financial health. It’s this assurance that gives investors, banks, and regulators the confidence to trust what they’re seeing.

Simply put, without the independent audit, the stock market as we know it couldn't function. The audit report is the stamp of approval that tells the world, "Yes, you can rely on these figures."

This isn't just a box-ticking exercise. It means digging into complex transactions, evaluating risks, and making sure everything aligns with constantly shifting accounting rules. Of course, for smaller businesses managing their own books, getting the fundamentals right is the first step. Our guide on accounting and bookkeeping software is a great place to start.

Tax: Navigating the Global Maze

If an audit is about confirming the past, tax is all about navigating the present and planning for the future. For any company operating across borders, the world of tax is a maddeningly complex web of different laws, regulations, and treaties.

The Big Four's tax experts help companies:

- Stay Compliant: Making sure clients are calculating and paying the right amount of tax in every single country they operate in, avoiding eye-watering penalties.

- Structure Smartly: Advising on the most tax-efficient, legally sound ways to structure deals, mergers, and investments.

- Manage Disputes: When the tax authorities come knocking with questions, these teams step in to represent their clients and find a resolution.

This is far more than just filing a tax return. It's a deeply strategic role that can dramatically affect a company’s bottom line and its freedom to grow internationally.

Advisory: The Strategic Partner

The advisory (or consulting) division is where the Big Four have seen phenomenal growth over the last few decades. Here, they step beyond the numbers to become strategic partners, helping clients tackle their biggest, most complex business problems head-on.

The scope of advisory work is huge and always changing. It can be anything from helping a company implement new technology or fend off cyberattacks to managing a massive corporate restructuring. Big Four firms also provide comprehensive business valuation services, which are essential for any merger, acquisition, or major strategic shift.

They’ve also adapted to the most pressing challenges of our time. Two of the fastest-growing areas in advisory today are:

- ESG Reporting: Guiding companies on how to measure, report, and improve their Environmental, Social, and Governance (ESG) performance to satisfy demanding investors and regulators.

- Cybersecurity: Helping clients protect their most valuable digital assets from a constant barrage of threats—a non-negotiable in today's world.

Navigating the Criticisms and Controversies

With that kind of global power comes a whole lot of scrutiny. The Big Four firms operate under an intense microscope, and you can't really understand them without looking at the serious criticisms and high-profile scandals that have dogged them for years. These aren't just minor slip-ups; we're talking about systemic issues that make you question the industry's entire structure and ethical compass.

From spectacular audit blow-ups to glaring conflicts of interest, these challenges are just part of their world. Anyone thinking of working with, or for, one of these giants needs to go in with their eyes wide open to these realities.

The Problem of Audit Failures

The headlines that do the most damage to the Big Four almost always involve a massive audit failure. An audit is supposed to be the gold standard, a stamp of approval that a company’s books are sound. Yet, history is littered with cases where a Big Four firm gave a clean bill of health to a company that was, in reality, a house of cards about to tumble.

Think about the huge corporate implosions like Carillion in the UK or Wirecard in Germany. These companies collapsed right under the noses of their auditors. The fallout is devastating: shareholder savings get wiped out, thousands of people lose their jobs, and public trust in the whole financial system takes a nosedive.

Every time this happens, it kicks off a furious debate. Are the auditors getting too cosy with their clients? Or are they just not doing their jobs properly and missing obvious red flags? Either way, each collapse brings fresh calls for tougher rules and raises the uncomfortable question of whether the audit process itself is fundamentally broken.

Conflicts of Interest

One of the stickiest and most persistent criticisms centres on conflicts of interest. For decades, the Big Four have been building up their massively profitable advisory and consulting arms. The problem? They're often selling these services to the very same companies they're supposed to be independently auditing.

You can see how that gets tricky. Can a firm truly act as an impartial, sceptical watchdog for a company that's also paying it millions for consulting advice? The fear is that an auditor might pull their punches and avoid challenging management too aggressively because they don't want to risk losing a much larger consulting contract.

The core tension is simple: an auditor’s duty is to the public and investors, whilst a consultant’s duty is to the client. When both roles are housed under one roof, critics worry that the client’s interests will inevitably win out, compromising the integrity of the audit.

Regulators have tried to tackle this by putting rules in place to limit the kind of non-audit work firms can sell to their audit clients. But the debate is far from over, and many argue that the only way to truly restore trust is to force a complete separation of the audit and consulting businesses.

The Market Concentration Dilemma

The fact that the market has boiled down to just four dominant players has created its own set of headaches. This near-monopoly means the world’s biggest corporations have precious few options when they need an auditor.

When there's so little competition, quality can stagnate and innovation grinds to a halt. There's simply no pressure to do better. It also creates a "too big to fail" problem. If one of the Big Four were to collapse—like Arthur Andersen did back in 2002—the shockwaves sent through the global financial system would be catastrophic.

You can see this market dominance all over the world. In Italy, for instance, the Big Four command a staggering 89% market share among the country's largest public companies. Deloitte by itself audited 12 of the top 30 firms, pocketing 40% of the total audit revenue. You can dig into more of the numbers by checking out this European audit market concentration from Borsa Italiana research. Getting a handle on these dynamics is crucial to understanding the pressures that shape the entire professional services landscape.

Why High-Growth Companies Need a Big Four Partner

You might think the Big Four are just for global giants, but that’s an old-school view. For ambitious start-ups and scale-ups, these firms are much more than just auditors; they’re strategic copilots for navigating the often-bumpy road to the big leagues.

When you’re chasing that next funding round, credibility is your currency. Having a Big Four firm audit your books sends a powerful message to investors. It’s like an independent seal of approval on your financials, showing you’re serious about transparency and solid governance from day one.

That stamp of approval can make all the difference for VCs and private equity funds. They see a Big Four audit as more than just number-crunching—it’s a major de-risking of their investment. It gives them the confidence they need to get behind your vision.

Building a Foundation for Success

Beyond the audit, these firms offer hands-on advice that helps young companies build for where they’re going, not just where they are. It’s all about putting the right systems in place before explosive growth starts to show the cracks.

- Scalable Financial Systems: They'll help you design financial controls and reporting that can handle growing complexity. This stops the back office from imploding whilst the front office is busy winning.

- Cybersecurity and Risk Management: Start-ups are juicy targets for cyberattacks. A Big Four partner can spot vulnerabilities and build a security setup that protects your IP and customer data.

- M&A Readiness: When it’s time to buy another company or plan your own exit, their experience in due diligence is priceless. They make sure the deal is structured smartly and there are no nasty surprises hiding in the cupboard.

Basically, they help you start thinking and acting like a serious public company long before you ever ring the opening bell.

For investors, Big Four due diligence provides the assurance needed to back a venture confidently. It’s about replacing assumptions with verified facts, turning a promising idea into a bankable opportunity.

Managing Risk and Maximising Opportunity

As a company gets bigger, so do the compliance and regulatory headaches. This is especially true for businesses in a venture capital portfolio, where the stakes and stakeholder expectations are sky-high. Big Four firms have deep expertise here, helping start-ups turn what feels like a compliance burden into a real strategic advantage.

For example, their consulting can be key for companies looking to flip regulatory hurdles into a competitive edge. This piece on understanding portfolio risk and compliance for strategic advantage offers some great insights into this.

Their advisory work also covers the tricky world of new technology. They can show you how to properly manage and secure huge amounts of data, which is absolutely critical today. Our article on AI and data analytics dives into some of the opportunities and challenges here.

Bringing a Big Four firm on board is a strategic play for any high-growth company with massive ambitions. It tells the world—from investors to partners and future hires—that you’re building a solid, transparent, and global-ready business that’s poised for its next chapter.

How to Choose the Right Firm for Your Business

Picking the right professional services firm can feel like a make-or-break decision for your business, and frankly, it often is. On the surface, the Big Four accounting firms seem to offer the same menu of services, but dig a little deeper and you’ll find their strengths, industry focus, and even internal cultures are worlds apart.

The real key isn't just picking the biggest name on the block. It’s about finding a genuine fit—a team that gets what you’re trying to do. Think of it less like ticking a box and more like bringing on a long-term strategic partner.

First, Figure Out What You Actually Need

Before you even think about sending out a request for proposal, the most critical step is to look inwards. What does your business desperately need today, and where do you see it heading in the next three to five years? Getting this crystal clear from the start will save you a world of headaches later.

Kick things off by asking yourself a few direct questions:

- What's the main problem we're trying to solve? Are we on the path to an IPO and need an audit that will stand up to intense scrutiny? Or are we tangled up in messy international tax regulations?

- What industry are we in? Does a potential firm have a proven track record in our specific sector—be it fintech, life sciences, or retail? You want experts who already speak your language.

- What's our budget realistically look like? Can we stomach the premium fees that come with a Big Four name, or would a more cost-effective solution make more sense?

Answering these honestly gives you a solid framework to build a shortlist of firms that are actually suited to help you.

Looking Beyond the Big Four

The prestige of hiring a Big Four firm is undeniable, but it's a mistake to think they're your only option. There’s a whole world of excellent mid-tier or 'challenger' firms out there—think names like BDO, Grant Thornton, and RSM—that offer a fantastic alternative, especially for small and medium-sized enterprises (SMEs).

These firms often deliver a much more personal, hands-on service. Instead of feeling like a small fish in a massive corporate pond, you’ll likely get more direct access to senior partners and a team that feels like a true extension of your own.

Here's a quick breakdown of how they stack up.

Big Four vs Mid-Tier Firms a Quick Comparison

| Factor | Big Four Firms (PwC, Deloitte, etc.) | Mid-Tier Firms (BDO, Grant Thornton, etc.) |

|---|---|---|

| Global Reach | Extensive global network, ideal for large multinationals with complex cross-border needs. | Strong national and regional presence, often with international alliances but less integrated. |

| Brand Prestige | Unmatched. The name alone can add credibility with investors, lenders, and regulators. | Well-respected, but don't carry the same automatic weight as a Big Four brand. |

| Service Cost | Premium pricing reflects their brand, scale, and overheads. Generally the most expensive option. | More competitive and flexible pricing structures. Often provide better value for SMEs. |

| Client Focus | Primarily geared towards FTSE 100 companies and large public entities. | Often focus on SMEs, owner-managed businesses, and the non-profit sector. |

| Partner Access | Day-to-day contact is usually with managers and junior staff. Partner involvement is strategic. | More direct and frequent access to senior partners is common, leading to a more personal feel. |

So, what does this all mean for you?

The decision usually boils down to a trade-off. With the Big Four accounting firms, you’re paying for unparalleled global muscle and instant brand recognition. With a mid-tier firm, you’re often getting greater flexibility, more face-time with senior experts, and a lighter touch on your budget.

What’s more, mid-tier firms can be a brilliant choice if your needs are very specific. Many have carved out impressive niches in specialised areas, from forensic accounting to tricky business valuations. If that's on your radar, our guide on how to approach business valuation provides a solid primer.

Ultimately, there’s no single "best" answer. It all comes down to your company's size, budget, and where you're headed. Weighing the global clout of the Big Four against the tailored approach of the challengers is the smartest way to make a decision that will truly serve your business well into the future.

Got Questions About the Big Four? We Have Answers.

It's easy to get lost in the world of the Big Four. Whether you're a founder looking for an auditor, an investor doing due diligence, or just curious about these massive firms, a few common questions always seem to pop up. Let's clear the air and tackle them head-on.

What’s It Really Like to Work for a Big Four Firm?

Getting a job at one of the Big Four is often seen as punching a golden ticket in the business world. It’s an intense environment, no doubt about it. The pace is fast, and the hours can be brutal, especially during the infamous ‘busy season’ that runs from roughly January to April.

But here's the trade-off: you get world-class training, hands-on experience with some of the biggest companies on the planet, and a career ladder that’s clearly mapped out. Most people see it as a prestigious boot camp that sets them up for incredible opportunities down the line, whether that's in finance, accounting, or a future C-suite role.

Aren’t All the Big Four Firms Basically the Same?

This is a common misconception. On the surface, they all offer similar core services like audit, tax, and advisory. But dig a little deeper, and you’ll find they aren't just carbon copies of each other. Each firm has its own vibe, its own strategic focus, and its own areas where it truly shines.

For instance, Deloitte is a giant in the consulting world, whilst PwC has a long-standing, powerhouse reputation in audit. The right firm for you—as a client or an employee—really boils down to what you’re trying to achieve.

The truth is, the firm’s culture and specialisms can vary significantly. Choosing the right one means looking past the brand name and aligning their strengths with your specific needs, whether that's industry expertise or a particular service line.

How Did These Four Firms Get So Big Anyway?

It wasn't always just the four of them. Believe it or not, the industry used to have the ‘Big Eight’. A wave of massive mergers throughout the late 20th century started shrinking the pool and concentrating power among fewer, larger firms.

The final domino fell in 2002 with the collapse of Arthur Andersen in the wake of the Enron scandal. That seismic event cemented the market into the four global giants we know today. Their dominance is a result of that consolidation, a global footprint no one else can match, and a hard-earned reputation for tackling the world's most complex financial challenges.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.