E-commerce merchant solutions are basically the digital plumbing of your online shop. They’re the collection of tools and services that handle everything from the moment a customer hits 'buy' to the money safely landing in your bank account.

It’s the unseen, behind-the-scenes magic that makes online selling actually work.

What Are E-commerce Merchant Solutions Anyway?

Think of your online store like a busy high-street coffee shop. A customer walks in, picks their favourite flat white, and goes to pay. In the online world, that entire process is handled by a suite of e-commerce merchant solutions, all working together in perfect harmony.

Without them, your online shop is just a nice-looking catalogue with a broken till.

These solutions form the critical infrastructure that allows for the complex, secure, and lightning-fast exchange of information needed for every single sale. This isn't just about collecting cash; it's about building a smooth, trustworthy experience that makes customers feel confident enough to finish their purchase and come back for more.

The Coffee Shop Analogy

Let's stick with our coffee shop idea for a second. Every step a customer takes has a digital counterpart.

- The Payment Gateway: This is your digital cash register or card machine. When a customer types in their card details, the gateway grabs that info securely and sends it off to be checked.

- The Payment Processor: This is the go-between, connecting your gateway to the banks. It takes the payment request, talks to the customer's bank to see if they have the money, and then chats with your bank to get it settled.

- Order Management: This is your star barista. As soon as the payment gets the green light, the order management system shouts, "One flat white, coming up!" or, in your case, tells your warehouse team to pick, pack, and ship the product.

In short, an e-commerce merchant solution is the full toolkit that connects your online shopfront to the financial system. It’s what makes sure every sale is handled smoothly, safely, and without a hitch.

Getting this right became a massive deal in Ireland, especially after the pandemic. Online retail sales shot up from €6.5 billion in 2019 to a whopping €10.6 billion in 2021—that’s a 63% jump. This boom pushed Irish businesses to quickly get better payment and logistics systems in place. The ones who did saw their average order values climb by 12–18% after integrating everything properly.

This whole process is a fantastic example of how information and communication technology (ICT) is the backbone of modern business. You can read more in our guide explaining what information communication technology is.

The Building Blocks of Your Merchant Stack

To get your online store running properly, you need to understand the different pieces that make up your e-commerce merchant solutions. Think of it like building a high-spec computer; every part has a specific job, but they all need to work together perfectly to give you a fast, smooth experience. If one component is off, the whole system can grind to a halt.

Let's break down the essential cogs in this machine. Each one is crucial for guiding a customer from browsing your site to happily unboxing their order, building trust and keeping things efficient along the way.

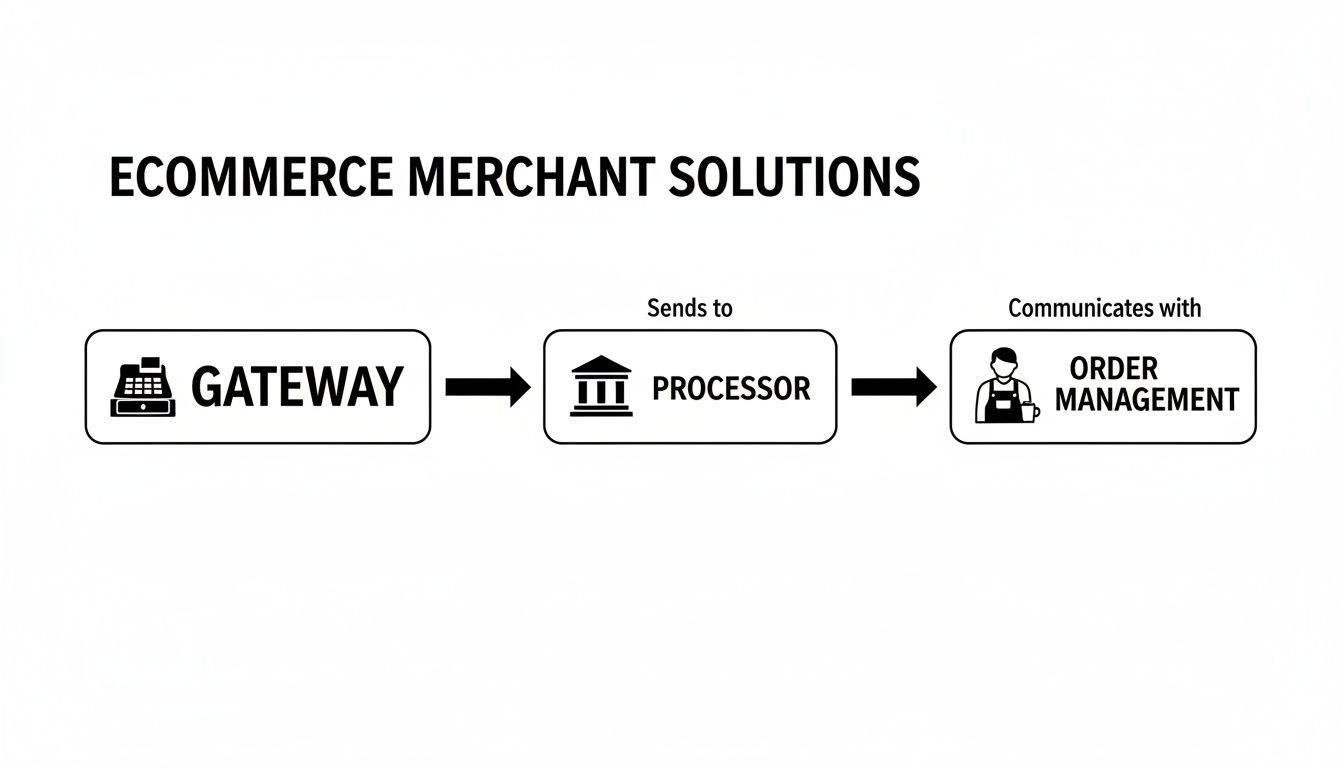

This visual shows the basic payment flow. The gateway acts like a digital till, passing information to the processor which talks to the banks. Once the payment is cleared, it kicks the order management system into action to get the product out the door.

It’s a simple illustration, but it really shows how tightly these systems are connected. Getting that integration right should be your top priority.

Payment Gateways and Processors Explained

First up, you have the payment gateway and the payment processor. People often use these terms interchangeably, but they do two very different—and equally vital—jobs.

The gateway is the secure digital terminal on your website. It’s the part that captures a customer’s card details, encrypts them to keep them safe, and then securely sends them on for authorisation.

That’s when the processor steps in. It acts as the go-between, connecting the gateway, the customer’s bank, and your business bank. It checks if the funds are available and, if everything looks good, it moves the money into your merchant account. These days, many Payment Service Providers (PSPs) like Stripe or Adyen bundle these functions into a single, slick service.

A PSP basically rolls the gateway, processor, and merchant account into one tidy package. This makes setup and day-to-day management a lot simpler, which is why it's a great choice for many Irish startups just getting off the ground.

Order and Inventory Management Systems

Once a payment clears, the next piece of the puzzle clicks into place: the Order Management System (OMS). This is the operational brain of your entire e-commerce operation.

It logs the new sale, automatically updates your inventory levels, and fires off all the necessary details to your warehouse or fulfilment partner. This is what gets the order picked, packed, and out for delivery.

A solid OMS stops you from selling products you don't actually have in stock—a classic mistake that can seriously damage customer trust. As you scale up, it can even synchronise your stock levels across multiple channels like your website, social media shops, and physical stores, giving you one clear view of your inventory.

Sophisticated Fraud Prevention Tools

In the online world, security is everything. Any good e-commerce setup needs to have robust fraud detection and prevention tools built-in. These systems hum away in the background, analysing transactions in real-time and looking for red flags that could point to a stolen card or other shady activity.

A few key technologies you’ll come across are:

- Address Verification Service (AVS): This just checks that the billing address the customer entered matches the one their card issuer has on file.

- Card Security Code (CVV): This confirms the customer physically has the card by asking for that three or four-digit code on the back.

- 3D Secure 2.0: This is a much more advanced security layer. It adds an extra authentication step, usually through a banking app or a one-time code sent to the customer’s phone, which drastically cuts down on the risk of fraudulent transactions.

To properly build out your merchant stack, you have to get the fundamentals of taking payments online right. This modern merchant's guide to accepting payments on your website is a great resource. Each of these components—from the initial payment to fraud checks—has to work in harmony to create a secure and efficient business that protects both you and your customers.

Choosing the Right Ecomm Solutions for Your Startup

Picking the right set of ecomm merchant solutions can feel like a mammoth task, especially when your main focus is building an incredible product and actually finding customers. But trust me, getting this right from day one will save you a world of pain later on. It’s all about finding partners who get your business now and can keep up as you grow.

Think of it like choosing the engine for your car. You don't just need one that's powerful enough for short trips around town; you need one that's reliable and efficient for those long motorway journeys you're planning. Going for the cheapest option might save you a few quid upfront, but it could cost you dearly in lost sales, frustrated customers, or operational chaos down the line.

Decoding the Cost Structures

One of the first things you'll bump into is the pricing. Most ecomm solution providers use one of two main models, and figuring out the difference is crucial for managing your cash flow.

-

Pay-as-you-go Transaction Fees: This is the most popular route. You pay a small percentage plus a fixed fee for every single sale (a common example is 1.4% + 25p). It’s brilliant for startups because your costs are directly linked to your revenue. If sales are slow one month, your payment processing bill gets smaller too.

-

Monthly Subscription Fees: Other providers will charge a flat monthly fee which covers a certain volume of transactions, usually with a lower per-transaction rate. This can be more economical once you have a high, predictable sales volume. But remember, it's a fixed cost you have to cover every month, come rain or shine.

There’s no one-size-fits-all answer here. It really boils down to your business model and how you expect to grow. A subscription might be cheaper at scale, but the pay-as-you-go model gives you much-needed flexibility when you're just getting started.

Ensuring a Seamless Tech Stack Fit

Your ecomm tools don't live on an island. They need to play nicely with your website platform, your accounting software, and your marketing automation tools. A clunky integration is a recipe for disaster—think hours of manual data entry, lost information, and a terrible experience for your customers.

Before you sign on the dotted line, you have to check their integration library. Do they offer a pre-built plugin for your platform, like Shopify or WooCommerce? If not, do they have a well-documented API that your developers won't hate working with? A solution that slots neatly into your existing setup is worth its weight in gold.

The real goal is a unified system where data flows effortlessly from the checkout, to your inventory management, and finally into your accounts. That kind of automation frees you up to do what you do best: grow the business, not get buried in admin.

Prioritising Compliance and Scalability

Lastly, you have to think about the long game. The solutions you choose must meet today's regulations and be ready to handle tomorrow's growth.

Compliance isn't optional. Any provider touching payments absolutely must be PCI DSS (Payment Card Industry Data Security Standard) compliant. This is the industry benchmark for protecting cardholder data. And with privacy laws like GDPR being so important, partnering with a compliant provider protects both your business and your customers.

Scalability is just as critical. The system that handles 100 orders a month with ease might completely fall over when you hit 10,000. Ask potential providers how they support growing businesses. Can their systems handle a massive traffic spike during a Black Friday sale? Do they offer features you'll need down the road, like multi-currency support for when you start selling internationally?

Choosing a partner that can scale with you from the beginning saves you from the expensive and disruptive nightmare of switching systems right when your business is hitting its stride.

To help you navigate these conversations, we've put together a simple checklist. Use this framework to compare potential vendors and find the one that truly fits your vision.

Ecomm Merchant Solution Evaluation Checklist

| Evaluation Criterion | Key Questions to Ask | Ideal Outcome for Your Business |

|---|---|---|

| Cost & Pricing Model | What is the exact fee structure (per transaction, monthly, hidden fees)? At what sales volume does your pricing become more cost-effective for me? | A transparent pricing model that aligns with my startup's cash flow and scales predictably as revenue grows. |

| Tech Stack Integration | Do you have a native plugin for my platform (e.g., Shopify, WooCommerce)? How comprehensive is your API documentation? What level of developer support do you offer? | A seamless, "plug-and-play" integration or a well-supported API that minimises development time and technical debt. |

| User Experience (UX) | Can I see a demo of the customer checkout flow? Is it mobile-optimised? Can it be customised to match my brand's look and feel? | An intuitive, fast, and frictionless checkout experience that builds customer trust and maximises conversion rates. |

| Compliance & Security | Are you fully PCI DSS compliant? How do you help merchants meet GDPR requirements? What are your fraud detection and prevention capabilities? | A rock-solid, compliant infrastructure that protects customer data, minimises my liability, and secures my revenue. |

| Scalability & Growth | How does your system handle sudden traffic surges? Do you support multi-currency payments and international transactions? What new features are on your roadmap for the next 12 months? | A reliable platform that can handle my projected growth without performance issues and offers the features I'll need to expand globally. |

| Support & Partnership | What are your support hours and channels (phone, email, chat)? Do I get a dedicated account manager? What is your typical response time for critical issues? | Responsive, expert support that feels like a true partnership, ensuring any issues are resolved quickly before they impact sales. |

This checklist isn't just about ticking boxes; it's about finding a long-term partner. The right provider will do more than just process payments—they'll be a key part of your growth engine.

Mastering Logistics and Delivery in Ireland

Getting that payment notification is a great feeling, but let’s be honest, it’s only half the battle. The real moment of truth—the one that decides if a customer comes back—is when that parcel actually arrives. Nailing your logistics and last-mile delivery is everything, especially in a place like Ireland where expectations are sky-high.

This is so much more than just shipping a box. It’s about crafting an experience that feels reliable, transparent, and genuinely convenient. Get this right, and you turn one-time buyers into loyal fans who tell their friends about you. Solid order fulfilment is the backbone here, and if you want to dig into the nuts and bolts, this guide on how to effectively fulfill orders is a great place to start.

Optimising Your Carrier Management

The foundation of a brilliant delivery experience is a smart carrier management system. Just picking one courier and sticking with them is almost never the best or cheapest way to do things. Modern e-comm solutions let you plug into multiple carriers at once, giving you the power to find the best rate and delivery time for every single order.

Think about it: you’ve got a small, light package going to Dublin. Your system could automatically pick a fast, local courier. But for a heavier box heading to rural Cork, a different national carrier might be way cheaper. This kind of real-time rate shopping can seriously slash your shipping costs without sacrificing speed.

Embracing Click-and-Collect and Flexible Delivery

The way Irish consumers want their stuff has changed. They demand options that fit around their hectic lives, and 'click-and-collect' is the perfect example. Letting people order online and grab their items from a physical spot—whether it's your own store or a partner's—is a convenience many now take for granted.

This hybrid model doesn't just make customers happy; it can also trim your last-mile delivery costs. To pull it off, you need a tight link between your online stock and your physical pickup points. That way, inventory is always accurate, and the whole process is a breeze for everyone involved.

The modern Irish consumer values choice above all else. Providing a menu of delivery options—from standard tracked post to next-day delivery and click-and-collect—is no longer a 'nice-to-have'. It's a fundamental part of competing effectively online.

Streamlining the Returns Process

Nobody enjoys returns, but a clunky, frustrating returns process is one of the quickest ways to lose a customer for good. In categories like fashion and footwear, Irish businesses can see return rates hitting 20-30%. Turning this potential pain point into a smooth, positive experience is a massive opportunity.

Automated returns systems are a game-changer here. These tools let customers generate their own return labels and track their parcels without ever needing to email your support team. By partnering with drop-off networks, you make it incredibly easy for them. And for you? This kind of automation can cut your admin costs by an estimated 15-25% and gives you incredibly useful data on why products are coming back.

The Growing Importance of Sustainable Delivery

Sustainability is no longer a niche concern; it's actively shaping how people shop. Recent surveys show that around 40% of Irish consumers would happily choose a slower, consolidated delivery if it meant a smaller carbon footprint. This is a golden opportunity for ethical brands to connect with customers on a much deeper level. For more on this, check out our article on enhancing supply chain sustainability with AI.

Building greener shipping options right into your checkout is a powerful statement. The latest e-comm solutions can now show the environmental impact of different delivery choices, letting customers make a call that aligns with their values. This kind of transparency doesn’t just build trust; it cements your brand as a forward-thinking, responsible player.

A Practical Implementation Roadmap

Theory is one thing, but making it happen is where the real work begins. Once you’ve picked your partners, it’s time to roll up your sleeves and weave these e-commerce solutions into the fabric of your business. This isn't a one-off setup; it's a gradual rollout that grows and changes right alongside your company.

The smartest play is to start with a rock-solid foundation and add the fancy stuff later. This gets you out the door and making sales quickly, all while building a system that can handle your future ambitions without needing a complete tear-down and rebuild.

Stage 1: The Early-Stage Startup Essentials

When you’re just getting off the ground, the only thing that matters is having a secure, reliable way to take payments and get orders out the door. That's it. Over-engineering things at this point just leads to launch delays and headaches you don't need. Focus on the bare essentials that let you start trading.

Your initial to-do list should be short, sharp, and all about speed and simplicity.

- Secure Payment Gateway Integration: This is your top priority. Hook up your chosen payment service provider (PSP) to your e-commerce platform. Most modern platforms like Shopify or WooCommerce have brilliant, almost plug-and-play integrations that you can get running in minutes.

- Basic Order Management Setup: Get your system configured to grab order details, fire off confirmation emails to customers, and ping you or your team that an order is ready to be picked and packed.

- Team Training on Core Functions: Even if your "team" is just you, get comfortable with the new setup. Know how to process an order, handle a refund, and check on a transaction. This is crucial for handling those first customer service queries with confidence.

- Clear Customer Communication: Make sure your website's FAQ and checkout pages are updated. Tell people which payment methods you accept and give them a clear way to get in touch if they hit a snag.

For a new startup, the aim isn't perfection; it's momentum. A successful implementation means you can securely take that very first payment and reliably ship that very first order.

Stage 2: Gearing Up for Growth

Right, so you've got a steady stream of orders coming in and you're starting to think bigger. Now it's time to build on that solid foundation. The focus shifts from just surviving to actually thriving, which means adding layers of automation and polish to your setup.

At this point, you're bracing for higher sales volumes and more complicated operations. Your roadmap now includes more advanced tools to help you manage this growth without the wheels coming off.

- Multi-Channel Inventory Sync: If you’re selling on your website, a marketplace like Etsy, and through social media, you absolutely need a single source of truth for your stock levels. Integrating a system that syncs inventory across all channels in real-time is a game-changer. It stops you from accidentally selling the same item twice.

- Advanced Fraud Analytics: As your sales climb, you unfortunately become a bigger blip on the radar for fraudsters. It's time to switch on more advanced fraud prevention tools. This could mean setting custom rules (like flagging orders over a certain value) or using machine learning to spot dodgy patterns before they cost you.

- Automated Reconciliation: Manually ticking off sales records against your bank statements is a soul-destroying task. Hooking up your payment systems to your accounting software (like Xero or QuickBooks) automates this, saving you hours and cutting down on mistakes.

- Customer Self-Service Portals: Give customers the power to track their own orders, start a return, or manage their subscriptions without having to email you. This frees up your team to handle the trickier issues and makes for happier, more independent customers.

Thinking about your needs in distinct stages helps clarify what's truly important right now versus what can wait. The table below breaks this down further.

Ecomm Solution Implementation Stages

| Business Stage | Core Priority | Essential Solutions | Key Metric for Success |

|---|---|---|---|

| Early-Stage | Launch & Validate | Secure Payment Gateway, Basic Order Management | First successful transaction |

| Growth-Stage | Scale & Optimise | Automated Reconciliation, Fraud Prevention, Inventory Sync | Improved operational efficiency (e.g., time saved) |

Ultimately, this phased approach ensures your technology keeps pace with your business. By starting lean and adding capabilities as you grow, you build a resilient operation that’s ready for whatever comes next.

Future-Proofing Your Ecomm Business

Your stack of e-commerce merchant solutions isn't something you can just set up and forget about. It’s a living, breathing part of your business, and it needs regular check-ups to make sure it’s still doing its job as you grow and the market shifts. If you stick with the same old setup for too long, you’ll quickly find yourself playing catch-up.

The real trick to future-proofing is to stay curious and get on the front foot. The world of online payments and logistics never sits still; what’s brilliant today could be a liability tomorrow. That’s why a regular audit of your tools, your costs, and what your customers are saying is absolutely vital for staying sharp.

This kind of continuous review keeps your business nimble. It means you're ready to adapt to new customer habits or tech breakthroughs without having to tear everything down and start again. It's all about making small, smart tweaks that add up to big gains over time.

Thinking Ahead of the Curve

To keep your operations out in front, you have to start anticipating what’s around the corner. This means keeping a close eye on emerging trends and figuring out how they might affect your business model before they actually do.

Here are a few areas worth watching like a hawk:

- New Ways to Pay: Think about how quickly digital wallets and 'Buy Now, Pay Later' services took off. You need to stay plugged into the next wave of payment options your customers will start asking for.

- AI in Fraud Detection: As fraudsters get more sophisticated, your defences have to get smarter. AI is quickly becoming the standard for spotting complex, dodgy patterns in real-time, offering a level of protection that old-school, rule-based systems just can’t touch.

Building a resilient e-commerce operation means accepting that your merchant stack is never truly 'finished'. It is an evolving asset that, when managed thoughtfully, becomes a powerful engine for sustainable growth in the competitive Irish and global markets.

This proactive mindset is your best defence against whatever comes next. When you combine it with a real understanding of how new tech can make your business stronger, you're putting yourself in a great position. For founders keen to dig deeper, our piece on the role of AI in data analytics is packed with valuable insights.

A Few Common Questions Answered

Diving into the world of e-commerce payments can feel a bit overwhelming, especially when you're just starting out in Ireland and trying to focus on building your brand. Let's tackle some of the most common questions that pop up.

What Sort of Processing Fees Should I Expect in Ireland?

This is usually the first question on everyone's mind, and for a good reason – transaction fees are a major cost. While the exact numbers will shift depending on who you go with, a good ballpark figure for an Irish startup is around 1.4% + €0.25 for each transaction made with a European card.

Just be aware that this can creep up for international or premium business cards. It's really important to get into the habit of reading the fine print. Some providers have hidden monthly fees or sting you with hefty penalties if a customer issues a chargeback.

Should I Go for an All-In-One Platform or Pick and Choose My Own Tools?

Ah, the classic build vs. buy dilemma. The right answer really comes down to where your business is at and how comfortable you are with the tech side of things.

-

All-In-One Platforms: Think of services like Shopify Payments. They’re brilliant for getting off the ground fast. Everything you need – the payment gateway, processor, and often even fraud protection – is bundled together. The massive win here is simplicity. It just works.

-

Individual Tools (The "A La Carte" Approach): This route gives you ultimate control. You can hand-pick the absolute best tool for every single job: the best processor for your rates, the smartest fraud detection system, and the most efficient logistics partner. Growing businesses often lean this way because they need very specific features or want to squeeze out better rates by playing vendors off each other.

Honestly, for most founders just starting their journey, an all-in-one solution is the way to go. You can always unbundle and build a more custom setup later when your needs get more sophisticated.

How Quickly Will I Actually Get My Money?

The time between a customer clicking "buy" and the cash actually hitting your bank account is called the payout time. For a small business, this is absolutely critical for managing cash flow.

Here in Ireland, you're typically looking at a wait of 2 to 7 business days. The more modern players, like Stripe, are generally much faster and can get money to you in as little as two days. Some of the more traditional banks or older payment systems, however, might hang onto your funds for a week or more. Make sure you ask about this upfront!

Getting your e-commerce merchant solutions right isn't just a technical task; it's a strategic move that shapes how efficiently you operate and how much your customers trust you. My advice? Start simple, make the customer's checkout experience flawless, and don't be afraid to revisit your setup every six months to make sure it's still the right fit as you grow.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.