The ASOS share price isn't just a number ticking up and down on a screen. It’s a story – a really dramatic one, actually – about a fast-fashion giant trying to find its footing in a world that’s changed under its feet. For anyone looking to invest or just understand the retail game, figuring out what's driving this story is everything.

So, What's Really Going on With the ASOS Share Price?

Right now, the ASOS share price reflects a company smack in the middle of a massive turnaround effort, facing some serious headwinds. For investors, that’s a classic high-stakes situation: plenty of risk, but also potential opportunity if they can pull it off.

Let's be blunt: ASOS was once the golden child of the London Stock Exchange. During the pandemic, it was flying high. Since then, its valuation has taken a nosedive. This guide is here to cut through the noise and give you a clear, operator's view of what’s happening. We’re not just going to stare at charts; we're going to dig into the why behind the numbers.

Here’s What We’re Going to Break Down

To get the full picture, we need to look at ASOS from a few different angles. Think of it like a business deep-dive, connecting what's happening in the boardroom to the share price you see online.

- Recent Performance & Volatility: First, we'll look at the recent rollercoaster ride of the ASOS share price, putting its 52-week highs and lows into some real-world context.

- Core Financial Health: Then we'll pop the bonnet and check the engine. We’ll go beyond the stock price to look at the fundamentals – revenue, profit margins, and the other numbers that show if the business is truly healthy.

- The Competitive Battlefield: We'll zoom out to see the bigger picture. This means looking at everything from the tough economic climate to the relentless pressure from rivals like Shein.

- What the Analysts Think: Finally, we’ll check in on what the City experts are saying and compare ASOS's valuation to its peers. Is it a bargain waiting to be snapped up, or a value trap?

The key is to see how all these pieces connect. A company's share price is a reflection of the entire business, not just a ticker symbol flashing on a screen.

Consider this your roadmap. Each section builds on the last, giving you a proper, structured look at where ASOS stands today. By the end, you’ll have a much clearer view of the challenges, the comeback plan, and what you should be watching for next. This is business strategy in action.

A Look at ASOS's Recent Stock Performance

If you've been watching the ASOS share price over the past year, you’ll know it’s been less of a steady climb and more of a white-knuckle rollercoaster ride. It’s been a period of gut-wrenching volatility, with sharp climbs followed by even sharper drops, leaving many investors feeling a bit queasy.

But this isn’t just random market noise. Every significant swing on the stock chart is a chapter in ASOS's ongoing turnaround story. From major announcements about its restructuring plan to wider jitters across the retail sector, the price action has been a live feed of investor confidence (or lack thereof) in the leadership's ability to navigate some very choppy waters.

The 52-Week Highs and Lows

To get a real sense of the drama, you just have to look at the numbers. ASOS Plc, which trades on the London Stock Exchange under the ticker ASC.L, has had a truly turbulent year.

At its peak, the ASOS share price hit a 52-week high of 454.20 GBX. But it later cratered to a low of 223.20 GBX—a staggering drop of over 50%. That kind of collapse really highlights the immense pressure the company is facing from shifting consumer habits, supply chain headaches, and brutal competition.

This kind of movement is a textbook example of how quickly sentiment can turn, especially for a big-name consumer brand. For any investor trying to make sense of it all, a crucial skill is learning how to read stock market charts. They aren’t just lines on a screen; they’re visual stories of market psychology, pinpointing the exact moments investor confidence either soared or completely evaporated.

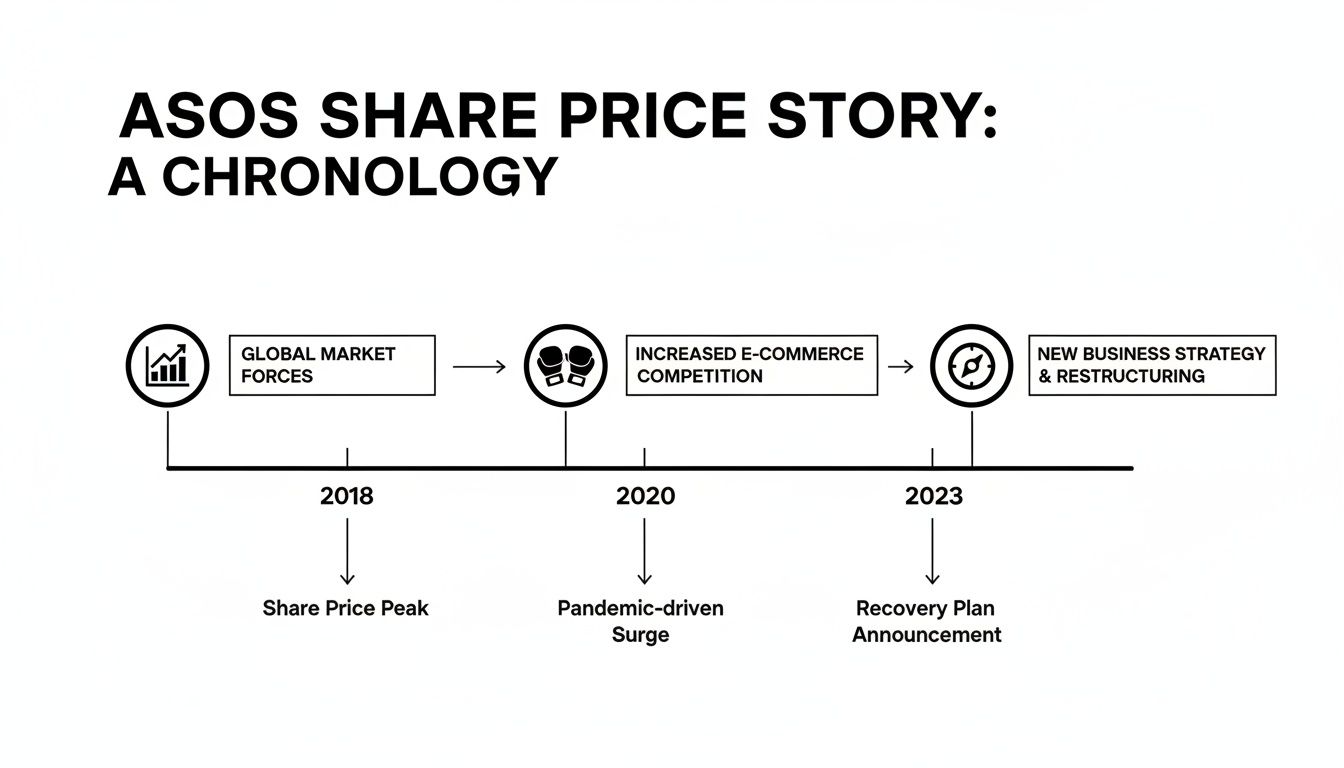

This timeline really hammers home the key forces—market pressures, competition, and strategic pivots—that have shaped ASOS's recent journey.

As you can see, the stock's performance isn't happening in a vacuum. It’s a direct consequence of these interconnected business challenges.

Interpreting Key Moments and Triggers

Certain events have been clear catalysts for the stock's biggest moves. For instance, any news about the company's "Driving Change" agenda—a plan to clear out old stock and slash costs—tends to cause ripples. Positive updates, like achieving a 30% increase in profit per order, can spark short-term rallies as investors see flickers of hope that the strategy is paying off.

On the flip side, even a whiff of weaker consumer demand or sales figures falling short of forecasts has triggered massive sell-offs. The retail sector is incredibly sensitive to the economic mood, and as a discretionary stock, ASOS is one of the first to get hit when shoppers start tightening their belts.

What Insider Trading Tells Us

Another fascinating layer to this story is what the insiders are doing with their own money. Their trading activity can sometimes offer clues about how confident leadership really is.

Lately, the signals have been mixed. For example, Non-Executive Director William Barker made some substantial share purchases. The market often sees that as a vote of confidence from someone who knows the company's inner workings.

But in contrast, CEO José Antonio Ramos Calamonte recently sold 1,991 shares. Now, sales like this can happen for all sorts of personal financial reasons that have nothing to do with the company's health, but they can still make other investors nervous.

The key takeaway here is that insider trades aren't a crystal ball, but they are an important piece of the puzzle. They offer a rare glimpse into the mindset of those closest to the business, adding another dimension to the whole ASOS share price narrative.

Ultimately, the recent performance of ASOS stock is a direct reflection of a business in the middle of a massive transformation. It's caught between its past struggles and its future ambitions, and every piece of news—good or bad—gets amplified in its highly volatile share price.

What ASOS's Financials Are Really Telling Us

The day-to-day jumps and drops of the ASOS share price are exciting, but they're only one part of the picture. To get a real feel for where the company stands, you need to lift the bonnet and take a proper look at the engine – its core financial metrics. This is where the true story of its health, efficiency, and resilience unfolds.

Think of financial statements as a company's annual health check-up. To really grasp ASOS's potential, investors have to move past the headlines and learn to analyse financial statements like a pro. These reports show whether the business is actually building muscle or just burning through cash.

Digging into Revenue and Profitability

For any retailer, sales are the lifeblood. But revenue is just the starting point. The real question is, how much of that money is actually sticking around as profit? That's where profit margins come in, and for ASOS, they've been under some serious strain.

Gross margin, for instance, tells you what’s left after paying for the products themselves. If that number is shrinking, it’s a big red flag. It often means ASOS is having to slash prices to get rid of stock, or its own costs are climbing—both have been major headaches for the company lately.

Then you have the net profit margin, which is the final number after every single expense is accounted for. When this is negative, the company is officially losing money. This has been a recurring theme in ASOS's recent reports and a massive source of anxiety for investors.

Here’s a quick look at the vital signs:

ASOS Key Financial Metrics At A Glance

This table summarises the most critical financial health indicators for ASOS, providing a quick reference for investors to gauge profitability, efficiency, and solvency.

| Metric | Value (TTM) | What It Indicates |

|---|---|---|

| Revenue | £3,061M | Declining sales signal a struggle to attract and retain customers. |

| Gross Margin | 41.2% | Shows how much profit is made on products sold, before overheads. |

| Net Margin | -9.6% | The company is currently losing money after all expenses are paid. |

| Return on Capital (ROCE) | -14.5% | The capital invested in the business is not generating positive returns. |

| Cash Conversion Cycle | 86.77 days | It takes nearly three months to turn inventory back into cash. |

These figures paint a clear picture of a company facing significant headwinds as it tries to navigate a tough turnaround.

Efficiency: How Well Is ASOS Using Its Money?

Profit is one thing, but smart investors also want to know how efficiently a company is using its cash to make that profit. This is where a metric like Return on Capital Employed (ROCE) becomes incredibly revealing.

Imagine you give two chefs the same amount of money to open a restaurant. One builds a thriving, profitable business, while the other just about scrapes by. The first chef has a much higher ROCE because they're better at turning investment into real returns.

The latest data for ASOS shows a Return on Capital Employed (ROCE) of -14.5%. This, combined with falling revenue and other negative metrics, is a clear signal that the money tied up in the business isn't generating a profit right now. To dig deeper into these numbers, you can explore the detailed summary from GuruFocus about ASOS's performance.

When a company's ROCE is negative, it's like a machine that costs more to run than the value of what it produces. The turnaround plan is all about fixing that machine so it becomes profitable again.

The Cash Conversion Cycle: A Retailer's Lifeline

For an online retailer, cash management is everything. The cash conversion cycle is a brilliant metric that measures how many days it takes for the company to turn its investment in stock back into cold, hard cash from a sale. The shorter, the better.

ASOS's cash conversion cycle is currently 86.77 days. That means it takes almost three months from the moment ASOS pays for a dress to the moment it gets the cash back from the customer who bought it. In a world of high-interest rates, that's a long, expensive time to have capital tied up in a warehouse.

This lengthy cycle puts a huge strain on the company's day-to-day cash. While ASOS has made strides in clearing out its excess inventory, tightening up this metric is absolutely crucial for its financial stability. We've written a guide on why this matters so much, which you can read here: protecting and understanding your cash flow.

So, while the daily share price tells you how the market feels about ASOS, the financial statements show you the reality on the ground. They reveal a business deep in a tough fight to get its profit, efficiency, and cash-generating engine firing on all cylinders again.

The Key Forces Shaping the ASOS Share Price

So, what actually makes the ASOS share price jump around every day? It’s not random. The price is a direct reaction to a whole mix of powerful forces, both inside and outside the company. For any investor, getting a grip on these drivers is the only way to see past the ticker symbol and understand the real story behind the numbers. Think of it like being a ship's captain – you have to know the weather, the currents, and the state of your own vessel to get anywhere safely.

Every business lives and dies by the health of the wider economy, and ASOS is no different. Its fate is tangled up with the financial well-being of its core customers: young, fashion-savvy shoppers who are usually the first to tighten their belts when money gets tight.

Macro-Economic Headwinds

When inflation bites and the cost of living soars, people have less spare cash. For a company that sells clothes and accessories – things people want rather than need – this is a huge problem. Shoppers start looking for cheaper alternatives, put off buying that new jacket, or simply stop browsing altogether.

This squeeze on spending power has been a massive, persistent headwind for ASOS. In many ways, the company's sales figures have become a bit of a barometer for the retail sector. When customers feel the pinch, it hits revenue, which spooks investors and drags the share price down. It's a classic chain reaction.

The Competitive Landscape

The online fashion world is a battlefield, and the pressure on ASOS has never been more intense. The explosive growth of ultra-fast-fashion giants like Shein and Temu has completely rewritten the rulebook. These new rivals are incredibly agile, pumping out new styles at rock-bottom prices and grabbing the attention of ASOS's target audience.

This isn't just about a price war; it's a fight for relevance, speed, and eyeballs. The heat from these new players means ASOS has to work much harder to win over every single customer. That often translates into more spending on marketing and running more sales, both of which can eat away at profits.

The real test for ASOS is finding a way to stand out in an incredibly crowded market. It can't just be about having the latest trends anymore. It needs to give customers a reason to choose them, whether that's through better quality, a standout customer experience, or a brand people genuinely want to be loyal to.

Operational Challenges

It’s not just external pressures. ASOS is also wrestling with some significant internal problems that directly affect its profitability and, you guessed it, its share price. Running a massive, complex global supply chain is a huge undertaking at the best of times, let alone when global disruptions are becoming the norm.

And then there’s the age-old problem for online fashion: returns. High return rates have always been a thorn in the industry’s side. Every single item sent back costs money to process, ship, and restock. Worse, if it can’t be resold at full price, it becomes a write-down. These operational drags are a direct hit to the bottom line. Getting returns management right is a major focus for any e-commerce operator; for a closer look, our guide on effective e-commerce merchant solutions dives deep into how to streamline these processes.

Strategic Shifts and Leadership

Faced with all these challenges, ASOS has kicked off a major turnaround plan under a new leadership team. The strategy is all about steadying the ship and getting the business back to profitable growth.

This multi-year plan is focused on a few core areas:

- Fixing the Stock Problem: ASOS is on a mission to clear out old inventory. It has already slashed its stock position by over 60% since the end of FY22. This not only frees up a load of cash but also allows it to be much smarter and faster with its buying.

- Slashing Costs: The company is getting lean. It's aggressively cutting costs right across the business, including shrinking its warehouse footprint, to build a more efficient operation.

- Focusing on Profit: The new mantra is simple: profit before growth. This means being more disciplined on pricing and promotions, and prioritising orders that actually make money. The early signs are promising, with the company reporting a 30% increase in profit per order thanks to these changes.

Every announcement about this turnaround is watched like a hawk by the market. Good news can boost investor confidence and lift the share price, but any hint of a setback can send it tumbling. For anyone invested in ASOS, keeping a close eye on how this plan is playing out is absolutely essential to figuring out where the share price might go next.

Is the ASOS Stock Undervalued or a Value Trap?

When a household name like ASOS takes a nosedive on the stock market, investors all ask the same question. Is this a golden opportunity to snap up a great business on the cheap, or is it a classic value trap—a stock that looks like a bargain but is actually heading for more pain?

That’s the million-pound question, isn’t it? The answer really hinges on whether you believe ASOS’s current woes are just a rough patch or a sign of a fundamental, long-term problem. It’s a huge judgement call, and one that requires a clear head to look past the noise and focus on the facts.

A good starting point is to see where the professionals are placing their bets. Analyst ratings give you a quick snapshot of market sentiment, but remember, they're just one piece of the puzzle, not a crystal ball.

Understanding Analyst Ratings

Look up the ASOS share price and you’ll see terms like 'Buy', 'Hold', or 'Sell' thrown around. Here’s a simple breakdown of what they actually mean:

- Buy: An analyst with a 'Buy' rating thinks the stock is a bargain at its current price and expects it to do well. They’re betting on a successful turnaround.

- Hold: This is the neutral ground. It suggests the stock is probably fairly priced, with the risks and potential rewards more or less balanced. Don't expect fireworks, but don't expect a crash either.

- Sell: This is a red flag. A 'Sell' rating means the analyst believes the stock is too expensive or faces major challenges that could push the price down even further.

The consensus on ASOS has been all over the place, which tells you just how uncertain its future is. Some analysts see the massive price drop as a tempting entry point, while others are staying on the sidelines, pointing to the brutal competition and shaky consumer confidence.

A low share price doesn't automatically mean a stock is a bargain. The critical distinction is between a great company going through a tough time and a troubled company whose best days are behind it.

Comparing ASOS Using Valuation Metrics

To get beyond gut feelings, we need to look at valuation metrics. These tools help us compare a company’s share price to its actual financial performance, giving us some much-needed context.

For a retailer like ASOS, one of the most useful metrics right now is the Price-to-Sales (P/S) ratio.

This handy ratio compares the company’s total stock market value to its total annual sales. A low P/S ratio can signal that a stock might be undervalued, especially when you stack it up against its competitors. Since ASOS isn't currently profitable, looking at P/S is a lot more useful than the more famous Price-to-Earnings (P/E) ratio. For a deeper dive into this, have a look at our guide offering expert advice on business valuation.

Let's see how ASOS stacks up against some of its rivals.

ASOS Valuation Multiples vs Key Competitors

This table gives us a quick snapshot of how ASOS is valued compared to other big names in online fashion. It helps us see if it looks cheap or expensive relative to the rest of the market.

| Company | Price/Sales (P/S) | Price/Book (P/B) | Market Capitalisation |

|---|---|---|---|

| ASOS | ~0.10x | ~0.55x | ~£420 Million |

| Boohoo Group | ~0.20x | ~0.65x | ~£440 Million |

| Zalando | ~0.35x | ~1.30x | ~€6.0 Billion |

| Next PLC | ~1.50x | ~7.50x | ~£11.5 Billion |

Note: Figures are approximate and change with market fluctuations.

As you can see, ASOS trades at a significantly lower P/S ratio than its peers, which on the surface, makes it look very cheap. But this is where the "value trap" risk comes in—the market is pricing in a lot of uncertainty about its future growth and profitability.

At the end of the day, whether the ASOS share price is a historic opportunity or a dangerous trap comes down to one thing: your belief in the turnaround story. If you're a bull, you see a powerful brand with a solid plan to get its house in order. If you're a bear, you see a business fighting for its life against nimbler, cheaper rivals in a market that has completely changed.

Future Outlook and What Investors Should Watch

Let's be honest, figuring out where the ASOS share price goes from here is a bit like trying to predict the weather. You have to look at the storm clouds on the horizon but also keep an eye out for any breaks in the clouds. ASOS is at a make-or-break moment, and its future really depends on whether it can pull off its turnaround plan while navigating some serious external headwinds.

For any investor, this means cutting through the noise and focusing on the signals that actually matter. Is the recovery plan working, or is it starting to look shaky?

The big risks haven't disappeared. Competition from the ultra-fast-fashion giants is relentless, and convincing shoppers to spend money in this economy is a massive challenge. Any slip-up on their end or another hit to consumer confidence could easily knock them off course.

Potential Catalysts for a Share Price Recovery

So, what could actually get the stock moving in the right direction? A few things, actually. The most powerful trigger would be solid proof that their cost-cutting is paying off on the bottom line. They've already reported a 30% increase in profit per order, which is a great start, but the market wants to see that filter through to genuine, sustained profitability across the whole business.

Another huge boost would come from a brighter economic picture. If inflation cools down and people feel a bit more secure, they'll start spending on things like fashion again. That would be the tailwind ASOS desperately needs to get sales moving.

At its heart, the bull case for ASOS is about the company becoming a much leaner, smarter operator. If they can blend their well-known brand with a more disciplined way of doing business, they could come out of this whole mess much stronger.

Your Investor Checklist: What to Monitor

Instead of getting bogged down in the day-to-day price swings, zero in on the numbers that tell the real story. Here’s a simple checklist of what to look for in the next few company updates. These are the real clues as to whether the turnaround is working.

- Profit Margins: Are gross and net margins heading up? This is the clearest sign of whether their "profit before growth" mantra is actually working. Seeing those margins consistently expand would be a massive vote of confidence for the ASOS share price.

- Inventory Levels: Keep an eye on the stock levels. They need to keep coming down. ASOS has already slashed its stock by over 60% since FY22, and a lean inventory means less cash is stuck on warehouse shelves and less need for profit-killing sales.

- Customer Metrics: Watch the active customer numbers and how much it costs to bring in new ones. Are they holding onto their loyal shoppers without throwing money away on expensive marketing? Nailing this is key to getting back to sustainable growth.

The ASOS saga is far from over. By keeping a close watch on these key operational and financial signposts, you can build a much clearer, evidence-backed opinion on whether the company is truly on the road to recovery.

A Few Final Questions on ASOS

When you're digging into a stock like ASOS, a few key questions always seem to pop up. Let's tackle some of the most common ones to round out your understanding.

So, Why Has the ASOS Share Price Tanked?

It’s really been a perfect storm. The dramatic fall in the ASOS share price isn't down to one single thing, but a nasty mix of pressures. You've got the rise of hyper-aggressive competitors like Shein, runaway inflation hitting their core twenty-something customers right in the wallet, and some serious internal growing pains—think mountains of unsold stock and a returns problem that got out of hand.

All of this came together to hammer their sales and profits, which naturally spooked investors and sent the share price tumbling.

Is ASOS Actually Still a Good Business?

That’s the million-pound question, isn't it? The core of the business—a globally known brand with a huge, dedicated following—is still there. That's a massive asset. But right now, ASOS is in the thick of a painful, but necessary, turnaround. They're trying to get leaner, smarter, and more profitable.

Whether they pull it off will determine their future. The long-term value here completely depends on their ability to adapt to this new, brutal retail world and prove their new strategy works.

What’s the Ticker for ASOS Shares?

If you want to follow along on a trading platform or financial site, ASOS plc is listed on the London Stock Exchange (LSE).

Just type in the ticker symbol ASC.L to get the live share price, charts, and all the latest news.

Who Are the Main Rivals I Should Watch?

ASOS is fighting a war on multiple fronts. The competitive landscape is fierce, and its main rivals fall into a few camps:

- The Old Guard: Think of the other big online fashion players like the Boohoo Group and Inditex, which owns Zara. They've been direct competitors for years.

- The New Disruptors: This is where the real pressure is coming from. Ultra-fast-fashion sites like Shein and Temu have completely changed the game with rock-bottom prices and lightning-fast trend cycles.

- The High Street Hybrids: Don't forget the established high street names with powerful online operations, like Next PLC. They're all chasing the same shoppers.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.