Here's your practical, no-fluff guide to the world of investment funds in Ireland. If you're a founder hunting for capital or an investor searching for the next big thing in tech, getting your head around this space isn't just useful—it's a real competitive edge. Forget the jargon; we're going to break down what Ireland's powerhouse status actually means for innovators like you.

Why Ireland? A Global Magnet for Investment Funds

Ever wondered how a small island on the edge of Europe became such a heavyweight in the world of investment funds? It was no accident. Ireland deliberately built an environment that pulls in capital from every corner of the globe, making it a top-tier spot for setting up and managing funds. We're talking trillions of euros in assets under management in Irish-domiciled funds. That's a serious stamp of approval.

This didn't just happen overnight. It’s the result of decades spent building a stable, pro-business climate. The country offers a predictable and solid framework, which is exactly what investors need to see before they commit serious money. For a tech founder, that stability translates into access to a deep and reliable pool of capital.

The Secret Sauce Behind Ireland's Success

So, what really sets Ireland apart? It’s a unique blend of ingredients that just work incredibly well together. Think of it as a well-oiled machine, fine-tuned for efficiency and growth.

- Rock-Solid Regulation: The Central Bank of Ireland is known worldwide for its sensible and straightforward approach. It provides clear rules, and that gives investors huge confidence.

- Deep Talent Pool: You can't swing a cat without hitting an expert in fund administration, law, or compliance. Ireland has an incredible depth of professional talent, meaning top-tier support is always on hand.

- An English-Speaking Gateway to Europe: As the only native English-speaking country in the Eurozone, Ireland offers a smooth entry point for major international investors, especially from the US and UK.

Ireland’s appeal isn't just about a favourable tax regime; it's the whole package—a complete, world-class ecosystem. This environment provides the certainty and infrastructure needed for both fund managers and the game-changing companies they back to really succeed.

This powerful mix creates a snowball effect. The more funds that set up here, the more talent and expertise flock to Ireland. This, in turn, makes the country even more attractive, solidifying the link between investment funds and Ireland as a byword for reliability and opportunity.

For founders and investors in fast-moving sectors like AI and fintech, this ecosystem is the perfect launchpad for scaling big ideas and making a genuine impact.

Cracking the Code on UCITS, AIFs, and ICAVs

Jumping into the world of Irish investment funds means you'll quickly run into a few key acronyms. At first, hearing terms like UCITS, AIF, and ICAV can feel like trying to decipher a secret code. But they’re not as complicated as they sound.

Think of them as different types of containers for holding and managing investments, each built for a specific job. You wouldn't ship a delicate glass sculpture in a flimsy paper bag, right? You'd choose the right box for the job. It's the same principle here—these structures are just specialised vehicles for different investment strategies.

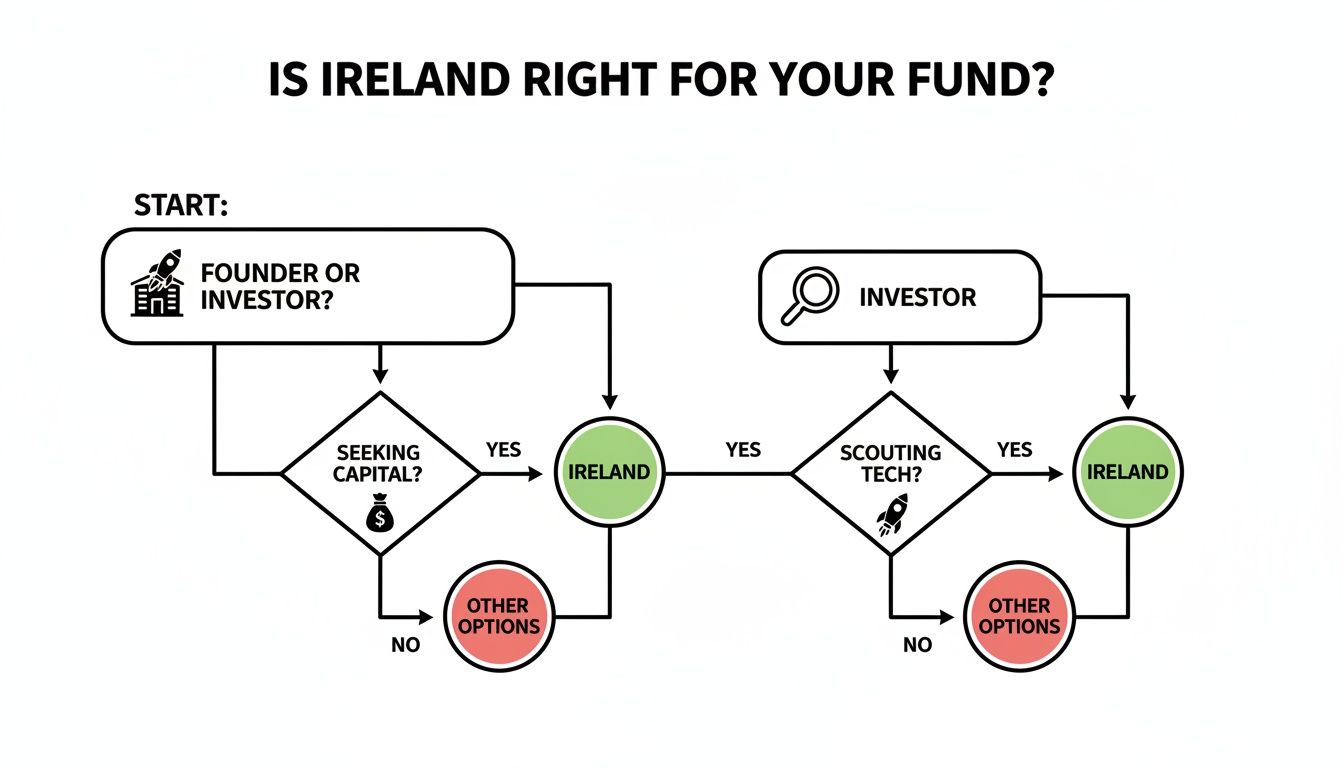

This decision tree helps visualise whether Ireland's fund structures are the right fit for you, whether you're a founder looking for capital or an investor searching for the next big thing in tech.

As the flowchart shows, Ireland’s well-oiled ecosystem serves both sides of the innovation coin, offering clear pathways for those seeking capital and those looking to deploy it.

UCITS: The Gold Standard for Investor Protection

A UCITS (Undertakings for Collective Investment in Transferable Securities) is essentially the ‘blue-chip’ brand in the fund world. It’s highly regulated, globally recognised, and trusted for one main reason: fierce investor protection.

These funds are designed for the retail market, which means they can be sold to the general public across the EU and many other countries. Think of a UCITS as a premium savings account that's available to everyone. The rules are strict—they have to be diversified, liquid, and steer clear of overly complex or risky assets. For mainstream investors and pension funds, that UCITS badge is a powerful symbol of safety and transparency.

AIFs: Flexibility for Specialised Strategies

On the other side of the coin, you have AIFs (Alternative Investment Funds). If UCITS are the safe, steady workhorses, AIFs are the specialist vehicles built for more adventurous journeys. They're aimed at professional and sophisticated investors—think venture capital firms, institutions, and family offices—who get the risks and can stomach them.

AIFs offer a massive amount of flexibility. They can dive into anything from property and private equity to venture capital and infrastructure projects. This adaptability makes them the perfect tool for funding an early-stage AI start-up or a new renewable energy plant—the kind of niche opportunities that don't fit into a standard box.

The sheer scale of Irish-domiciled funds is staggering, cementing the country's dominance in Europe. By November 2024, UCITS assets alone had rocketed to €4.027 trillion, marking an €810 billion jump from the end of 2023. This is part of a bigger picture where the total Net Asset Value (NAV) of all Irish funds has climbed for eight straight quarters, hitting €4.676 trillion by Q3 2024. For founders and investors, this giant pool of capital is a stable, powerful launchpad for big ideas.

ICAV: The Modern Vehicle of Choice

Finally, let's talk about the ICAV (Irish Collective Asset-management Vehicle). The ICAV isn't a type of fund strategy like UCITS or an AIF. It's the modern corporate structure—the ‘chassis’—that the fund is built on. Introduced back in 2015, it was designed from the ground up for the funds industry and has quickly become the default choice for just about everyone.

So, what’s all the fuss about? The ICAV is a corporate body, but it’s way more flexible and efficient than a traditional company. It’s quicker to set up, has fewer administrative headaches, and is incredibly tax-efficient. The real kicker, though, is that it's recognised in the US as a transparent entity, which is a massive plus for attracting American investors. For most VCs and tech-focused funds, the ICAV is a no-brainer.

If you’re also exploring retail investment options, our guide to https://scottdylan.com/blog/business/mutual-funds-ireland/ offers a closer look. And to stay ahead in this complex market, keeping up with the latest Hedge Fund Intelligence is essential.

UCITS vs AIFs vs ICAVs: A Simple Comparison

To bring it all together, here’s a quick breakdown of how these structures stack up against each other. It’s a simple way to see the key differences at a glance.

| Feature | UCITS | AIFs (e.g., QIAIF) | ICAV |

|---|---|---|---|

| Target Investor | Retail / General Public | Professional / Sophisticated Investors | The corporate structure used by both UCITS and AIFs. |

| Investment Scope | Restricted to liquid assets like stocks and bonds; high diversification. | Highly flexible; can invest in private equity, VC, property, etc. | Varies based on whether it's a UCITS or an AIF. |

| Regulation Level | Very high; strong focus on investor protection. | Lighter touch; assumes investors are sophisticated. | Governed by the Central Bank of Ireland, tailored for funds. |

| Key Advantage | "Gold standard" brand, easily sold across the EU. | Investment flexibility for specialised strategies. | Tax efficiency, administrative simplicity, and US investor appeal. |

| Best For… | Mainstream funds, pension schemes, retail investment portfolios. | VC, private equity, hedge funds, real estate funds. | The preferred legal 'wrapper' for most new Irish funds. |

Choosing the right structure really depends on who your investors are and what you plan to invest in. For most new, ambitious funds, an AIF housed within an ICAV structure is the winning combination.

Understanding Ireland's Resilient Fund Ecosystem

So, what’s the secret sauce behind Ireland's massive and enduring fund industry? It’s not just one thing. It's a potent mix of global trust, a deep bench of expertise, and a steady stream of capital that has created an incredibly stable environment for growth. The numbers are staggering, but they tell a story that goes beyond just money—they speak to a solid infrastructure that consistently stands firm against global economic headwinds.

This resilience isn't just some abstract concept; it creates real-world opportunities. If you're an innovator in a field like AI, fintech, or healthcare, the sheer strength of the Irish fund market means there's a reliable and deep well of capital you can tap into. It’s all about connecting the dots between those huge institutional investments and the funding that actually fuels ground-breaking ventures on the ground.

The Scale of Capital and What It Means for Innovators

The sheer volume of assets managed in Ireland is a billboard advertising its global significance. But this isn't a sleepy, passive pool of money. It’s an active, buzzing ecosystem where capital is constantly being funnelled into new opportunities. For founders, the big takeaway is this: Ireland is where serious, large-scale investment decisions get made, day in and day out.

This scale also acts as a shock absorber. When global markets get turbulent, the diversity and depth of funds domiciled here help maintain a sense of calm. Investors know this, which is why they continue to see it as a safe harbour for their assets. It’s a classic virtuous cycle—confidence attracts more capital, which in turn reinforces the ecosystem's strength.

For founders and investors with an eye on growth, it's crucial to see Ireland's fund sector for what it is: not just a number on a balance sheet, but a highly sophisticated financial engine, fine-tuned to channel global capital into high-potential ventures with efficiency and regulatory certainty.

This robust framework means that even when things feel uncertain, the flow of capital to promising sectors doesn't just dry up. For a closer look at managing your own finances through these periods, you can read our article on protecting and understanding your cash flow during times of uncertainty.

Bouncing Back Stronger: Market Resilience in Action

Time and again, the Irish funds sector has proven it can shake off global market shifts and come back stronger. This isn't just good luck; it's baked into its design. The ecosystem is dominated by long-term, institutional investors—the kind who are far less likely to hit the panic button during a short-term dip. Their steady hand benefits everyone involved.

Take a recent example. Even after some market jitters, the sector snapped back quickly, powered by strong inflows into key areas like equity funds. This was crystal clear when the Net Asset Value (NAV) of Irish-domiciled funds jumped to an incredible €5.01 trillion in Q2 2025, a hefty €57 billion increase from the previous quarter. What drove this? A massive €83 billion surge in Equity funds, a powerful vote of confidence in growth-focused assets. You can dig into the specifics in the Central Bank of Ireland's quarterly report.

This rush into equities is huge news for the tech community. It signals that despite whatever is happening globally, there’s a serious appetite for backing companies with high-growth potential. If you're a venture capitalist or an AI founder, this trend is a clear sign that the capital you need to scale ambitious ideas is right here. This reliability makes Ireland a fantastic place to build a business for the long haul.

Getting to Grips with Irish Regulation and Tax

Let’s be honest, the words ‘regulation’ and ‘tax’ can make even the most experienced founder break out in a cold sweat. But here’s the thing about investment funds in Ireland – the system is designed to turn these potential headaches into a genuine competitive edge. The goal isn’t to build walls; it’s to lay down clear, predictable tarmac for funds to thrive on.

The main referee here is the Central Bank of Ireland, which oversees all Irish investment funds. Its reputation for being tough but fair is a huge plus. It gives investors deep confidence, knowing a world-class watchdog is on the case, which in turn helps attract serious global capital.

For a fund manager, it means you’re playing on a well-marked pitch. The rules are clear, which cuts down on operational headaches and nasty surprises down the line.

How Ireland's Tax Regime Works for You

Ireland’s approach to tax is probably the biggest piece of the puzzle. The key idea to get your head around is tax transparency. Think of the fund as a clear glass pipe. Money flows through it, but the pipe itself doesn't get taxed on the income or gains passing through. Instead, the tax responsibility lands with the investors, back in their home countries.

This simple concept has some powerful benefits:

- No Double Dipping: It stops profits from being taxed once at the fund level in Ireland and then again when they reach investors. This efficiency is a massive draw for international money.

- Keeps It Simple for Global Investors: An investor in Germany or Japan doesn't have to navigate Irish tax law; they just deal with the rules they already know at home.

- Rock-Solid Predictability: These rules are well-established and clear, giving everyone the confidence to make long-term plans without worrying that the goalposts will suddenly move.

The whole system is built to help the funds industry grow, not to trip it up.

The secret sauce is the combination of a respected, robust regulatory framework with a super-efficient, transparent tax structure. This duo creates a stable, low-friction environment that lets fund managers do what they do best: back brilliant companies and generate returns.

This bedrock of trust and efficiency is exactly what you need to attract the patient, long-term capital that truly fuels tech and venture growth.

The Power of Ireland’s Tax Treaties

Another superpower in Ireland’s arsenal is its huge network of double taxation treaties. Ireland has these agreements in place with over 70 countries, covering all the world’s major economies. For a fund investing globally, these are absolutely critical.

Picture this: your Irish fund invests in a tech company in Japan and earns some dividends. Without a treaty, that income could get hit with a hefty tax in Japan before it even leaves the country. Ireland's treaties slash or even completely eliminate these "withholding taxes," making sure more of the return gets back to your investors.

This network essentially gives your fund a global passport, allowing it to move capital across borders with maximum tax efficiency. For a VC fund scouting for the next big thing internationally, this is a game-changer that directly boosts the bottom line.

Your Expert Crew for Staying Compliant

You don’t have to navigate this landscape alone. Far from it. Ireland has a world-class ecosystem of service providers – administrators, depositaries, auditors, and legal eagles – who are specialists in this very field.

These partners aren't just there to tick boxes. They are your compliance engine, making sure your fund stays on the right side of all regulatory and tax rules. They handle the complex, day-to-day grind, freeing you up to focus on your investment strategy. From investor reporting to Central Bank filings, they make sure everything runs like clockwork, giving you the peace of mind that your fund is built on solid, compliant ground.

How State Investment Acts as a Catalyst for Innovation

Private capital is a huge part of the story, but it’s not the whole picture. When you dig into what fuels innovation in Ireland, you'll find some of the most powerful and patient money comes from a strategic state player: the Ireland Strategic Investment Fund (ISIF). This isn't just another government fund; it’s a major force multiplier for Irish businesses.

ISIF runs on a unique mission known as the ‘double bottom line’. In simple terms, this means every investment it makes has to tick two boxes: generate a solid commercial return and create a positive economic impact for Ireland. It’s a smart blend of profit and purpose, all aimed at creating high-value jobs and driving the country forward.

For founders in tough, capital-intensive fields like deep tech, AI, and life sciences, having ISIF in the ecosystem is a game-changer. It signals that a major, long-term investor is ready to back ambitious ideas that might take years to see a return.

The Power of Co-Investment

The real magic of ISIF lies in its co-investment strategy. It rarely goes it alone. Instead, it teams up with private sector investors—both Irish and international—to back local companies. This approach doesn't just add money to the pot; it multiplies it.

Here’s how that plays out:

- De-risking for Private Investors: When ISIF commits to a deal, it sends a strong signal of confidence. Its rigorous due diligence acts as a stamp of approval, making private VCs and other funds far more comfortable putting their own capital on the line.

- Unlocking Bigger Funding Rounds: By matching or adding to private investment, ISIF helps companies raise significantly larger rounds than they could otherwise. This gives start-ups the proper runway they need to scale without cutting corners.

- Attracting Global Capital: ISIF’s involvement puts Irish companies on the radar of international investors who might have overlooked the market. This brings in fresh capital, new perspectives, and global expertise.

This public-private partnership creates a powerful ripple effect. It unlocks vast pools of capital that are absolutely essential for helping ambitious Irish companies compete on the world stage.

Real-World Impact and Proven Returns

The fund’s track record really speaks for itself. Since it was set up in 2014, ISIF has become a cornerstone of Ireland's innovation economy.

The core idea behind ISIF is simple but powerful: use state capital as a catalyst to unlock even greater private investment. It's a strategic play that ensures public money punches well above its weight, directly fuelling the growth of the next generation of Irish businesses.

The results are impressive. Over its first decade, the Ireland Strategic Investment Fund has not only committed €8.8 billion across hundreds of investments but has also catalysed an additional €12.6 billion in co-investments. This incredible 1.4x multiple has unlocked a total of €21.4 billion for Ireland's economy—a powerful demonstration of public and private collaboration in action. You can explore the full details in the NTMA’s mid-year business update.

This isn't just about big numbers, though. It’s about building a sustainable ecosystem. By backing ventures that create lasting value, ISIF helps ensure that Ireland remains a fertile ground for entrepreneurs and a magnet for global talent for years to come.

Your Step-by-Step Guide to Setting Up a Fund

Taking a brilliant investment idea and turning it into a real, operational fund isn’t magic—it's a process. It requires a clear, methodical plan that moves from the big-picture strategy down to the nitty-gritty of regulatory approval. Let's walk through that journey.

The groundwork starts long before any official applications are filed. The very first phase is all about strategy and structure. You need to nail down exactly what your fund is for, who you're raising money from, and the specific assets you plan to invest in. This is the stage where you'll pick the right vehicle for the job, which for many venture or tech-focused funds, will be an ICAV set up as an AIF.

A vital part of this early planning is creating a solid Investment Policy Statement template. Think of this document as your fund's constitution; it clearly lays out your investment philosophy and goals for everyone involved.

Assembling Your A-Team

Here’s a hard truth: you can't launch a fund on your own. Your success depends entirely on getting the right team of specialised service providers in place. These aren't just vendors; they are the operational backbone of your fund, and they're essential for navigating Ireland's complex regulatory world.

So, who do you need in your corner?

- Fund Administrator: This is your operational powerhouse. They handle the heavy lifting of day-to-day management, like calculating the Net Asset Value (NAV), processing investor subscriptions and redemptions, and managing all the reporting.

- Depositary: Think of the depositary as the guardian of your fund's assets. They have a critical oversight role, acting as a watchdog to ensure everything is being managed in the best interests of your investors.

- Legal Advisers: Your legal counsel is non-negotiable from day one. They'll draft the fund's core documents (like the prospectus) and expertly guide you through the entire Central Bank authorisation maze.

- Auditors: You'll need to appoint an independent auditor to review and sign off on the fund’s annual financial statements. This adds a crucial layer of transparency and accountability.

Choosing the right partners is one of the most important decisions you’ll make. It sets the entire foundation for a smooth, compliant operation.

The Authorisation Process and Timelines

Once your structure is locked in and your team is assembled, it's time to seek authorisation from the Central Bank of Ireland. This is a rigorous process, but it's a well-defined one. Your legal advisers will compile and submit a comprehensive application package containing the prospectus, constitutional documents, and agreements with all your service providers.

The Central Bank's review is incredibly thorough, with a sharp focus on investor protection and the fund's operational soundness. A well-prepared, detailed application is the key to a smooth approval, as it shows regulators your fund is built on a solid, compliant foundation.

So, how long does all this take? Typically, you can expect the timeline from initial drafting to final authorisation to be somewhere between four to six months. This can vary depending on how complex your fund is and how complete your application is.

Costs can also differ quite a bit, but it's smart to budget for legal, advisory, and setup fees that can easily run into the tens of thousands of euros. See this initial cost as an investment in building a credible, robust structure that will attract serious capital. While setting up a fund is a major undertaking, those looking for other ways to finance business growth might find value in exploring the four ways to fund a business acquisition.

Got Questions About Irish Investment Funds? We’ve Got Answers.

Let's wrap things up by tackling some of the most common questions we hear from founders, VCs, and investors looking at investment funds in Ireland. Think of this as the practical, no-fluff FAQ section to clear up any lingering doubts.

We'll get straight to the point on timelines, costs, and who you'll be rubbing shoulders with in the investor pool.

How Long Does It Really Take to Launch a Fund in Ireland?

This is the big one, isn't it? Realistically, you should budget for a four to six-month journey from the moment you say "go" to getting the final nod from the Central Bank of Ireland. That timeframe covers all the essentials: nailing down the structure, drafting the legal docs, and navigating the regulator's review.

The single biggest factor for a smooth ride? Preparation. Delays almost always crop up from incomplete paperwork or wishy-washy decisions. Having your ducks in a row with your legal and admin partners before you even start the clock is the best way to stay on track.

What Are the Main Ongoing Costs to Run a Fund?

Getting a fund off the ground is one thing, but keeping it running is another. There are ongoing operational costs you need to factor in, which are part of the deal when you're operating in a top-tier, regulated environment.

Here’s a quick rundown of what to expect:

- Administration Fees: This covers the day-to-day grind handled by your fund administrator—things like calculating the NAV, managing investor reports, and keeping records straight.

- Depositary Fees: You’re paying for a crucial layer of oversight. The depositary's job is to safeguard your fund's assets, and their fee reflects that responsibility.

- Audit and Legal Fees: These are your annual check-ups for financial statements and any ongoing legal advice you might need.

- Regulatory Levies: An annual fee paid directly to the Central Bank of Ireland for the privilege of their oversight.

These costs will naturally scale with your fund's size and complexity, but they are the standard price of admission for a robust, investor-friendly structure.

Look, if there's one thing to remember, it's this: while the initial setup takes a lot of effort, the ongoing operational side of things is incredibly well-supported. Ireland's ecosystem is packed with world-class service providers built to do the heavy lifting. This lets you get back to what you do best—focusing on your investment strategy and finding the next game-changing company to back.

Who's Actually Putting Money into Irish Funds?

One of the best things about Irish funds is the sheer diversity of the investor base. It’s genuinely global. While UCITS funds are open to pretty much everyone, AIFs—the go-to for VC and private equity—are aimed squarely at the professional crowd.

So, who are we talking about?

- Pension schemes and insurance companies from all over Europe and further afield.

- Major institutional players and sovereign wealth funds.

- Family offices and high-net-worth individuals looking for sophisticated opportunities.

This mix is a massive advantage. When your capital base includes long-term players like pension funds and insurers, you get a level of stability that's hard to beat. They aren't easily spooked by short-term market noise, which adds a welcome layer of resilience to your fund.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.