The price of palladium often catches people by surprise. It's a rare, silvery-white metal that has, at times, fetched a higher price than gold. Its value is overwhelmingly tied to the global car industry, where it's the unsung hero in reducing harmful emissions from petrol and hybrid vehicles.

What Is Palladium and Why Does Its Price Matter?

Palladium is much more than just a shiny precious metal; it’s an industrial workhorse. The best way to think of it is as a highly specialised filter. Its main job is inside a vehicle's catalytic converter, where it magically transforms toxic pollutants like carbon monoxide into less harmful substances like carbon dioxide and water vapour.

This direct link to the automotive sector makes the price of palladium a fascinating economic barometer. As governments around the world get tougher on emissions, the demand for more efficient catalytic converters—and therefore, more palladium—tends to climb. This tight relationship means that things like car sales figures and new environmental laws can send its price on a rollercoaster ride.

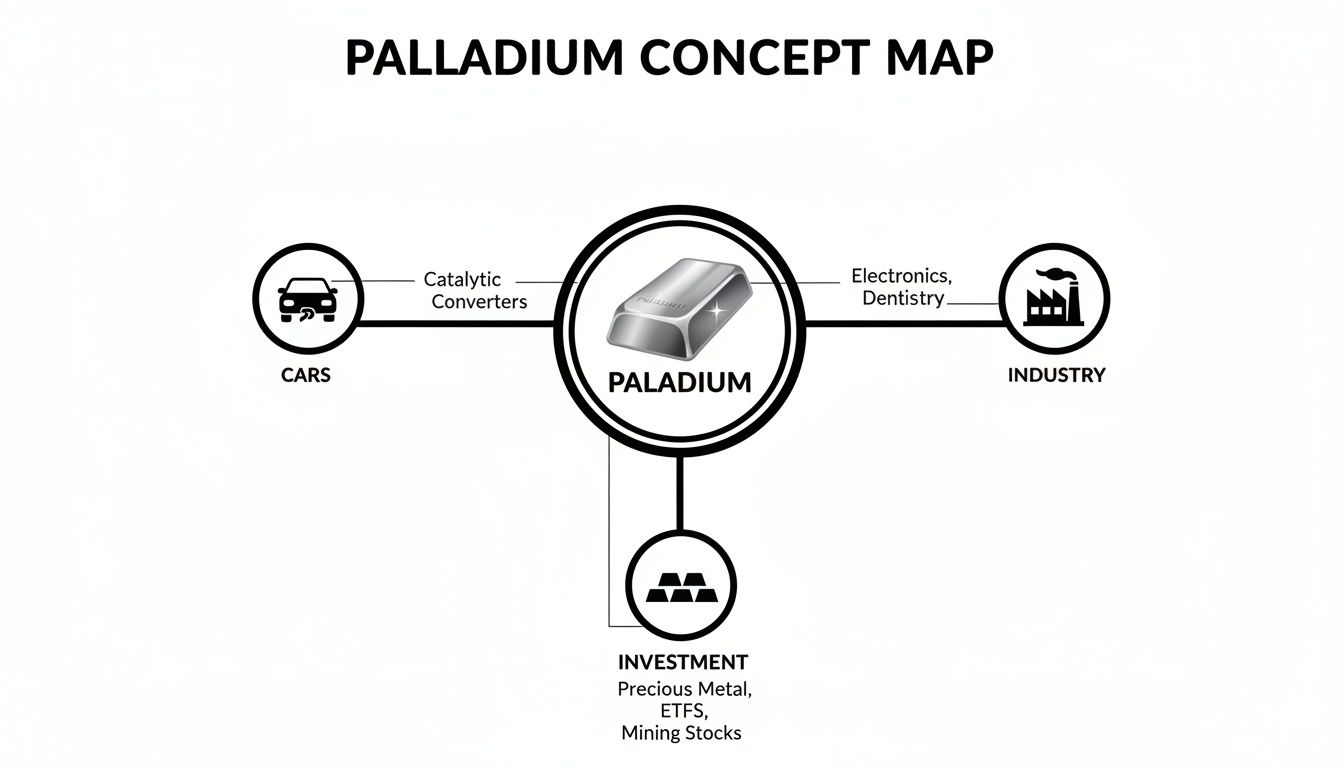

The infographic below neatly sums up the three pillars of palladium's value.

As you can see, its identity is split between being a critical industrial component and a financial asset for investors looking to diversify.

A Metal with a Dual Identity

Palladium really does live a double life. On one hand, it's an essential ingredient for modern technology. Beyond its starring role in cars, it's also used in:

- Electronics: It’s a key material in multilayer ceramic capacitors, tiny but vital components found in pretty much every smartphone and laptop.

- Dentistry: Some dental crowns and bridges use palladium alloys because they're incredibly durable and don't corrode.

- Jewellery: Often seen as a premium alternative to platinum, it's naturally white, hypoallergenic, and a popular choice for wedding rings.

On the other hand, it's a speculative asset. Traders and investors buy palladium through exchange-traded funds (ETFs), futures contracts, or even as physical bars, all in a bet on where its price is headed next. This financial trading adds a whole other layer of volatility and complexity to its valuation.

For businesses and investors, keeping an eye on commodities like palladium isn't just about speculation. It's about getting a read on supply chain costs and wider economic shifts. A sudden jump in the price of palladium can be a powerful signal of growing industrial demand or even geopolitical trouble brewing somewhere in the world.

To give you a clearer picture, here’s a quick breakdown of the forces that move the palladium market.

Key Factors Influencing Palladium Prices

The table below summarises the primary forces that determine the global price of palladium, providing a quick reference.

| Factor | Description | Impact on Price |

|---|---|---|

| Automotive Demand | ~85% of palladium is used in catalytic converters for petrol and hybrid cars. | Higher car sales or stricter emissions standards increase demand, pushing prices up. |

| Industrial Use | Used in electronics, dentistry, and jewellery. | Steady industrial growth provides a baseline of demand, supporting the price. |

| Supply Concentration | Russia and South Africa account for roughly 80% of global mine supply. | Any disruption (strikes, sanctions, political instability) can squeeze supply and cause prices to spike. |

| Investment Activity | ETFs, futures, and physical buying add a layer of financial demand. | Speculative interest can amplify price moves, both up and down. |

| Recycling | Palladium is recovered from scrapped catalytic converters. | Higher recycling rates can increase the available supply, potentially putting downward pressure on prices. |

Understanding these dynamics is key to making sense of the often-dramatic price swings we see in the palladium market.

Why Its Price Is a Vital Signal

Ultimately, tracking the price of palladium is about more than just watching a number on a screen. It’s a lens through which you can view the health of global manufacturing, the direction of environmental policy, and the mood of investors. For entrepreneurs and founders, these price signals can ripple through everything from production costs to overall financial stability.

Watching palladium gives you a way to feel the pulse of the real economy. For a deeper look into managing your company's financial health, our guide on protecting and understanding your cash flow during times of uncertainty offers some really practical insights.

What Really Moves the Needle on Palladium Demand?

To get a real handle on palladium's price, you need to know who's buying it and why. And when you look at the numbers, one industry stands out by a country mile: the automotive sector. The story of palladium demand is, for the most part, a story about the cars we drive.

Think about it this way: nearly every brand-new petrol or hybrid car has a bit of palladium hidden in its exhaust system. It's the magic ingredient in the catalytic converter, the device that zaps harmful pollutants from the exhaust before they ever reach the air we breathe. As governments around the world, especially in Europe and China, bring in tougher environmental laws, carmakers are forced to use more palladium in each vehicle to stay compliant.

This creates a really direct and powerful link between a country's environmental policy and the global palladium market. When a new rule like the "Euro 6" emissions standard comes into play, it’s not just a headline for environmentalists—it’s a massive buy signal for palladium producers. This regulatory squeeze almost always means the industry needs more of the metal, which often sends the price of palladium skyward.

The Car Industry's Insatiable Appetite

The motor industry’s dependence on palladium is staggering, making up around 85% of all global demand. This heavy concentration means what happens in the car world is the main driver behind any big price swings.

- Global Car Sales: It's simple, really. When more cars are sold, the demand for palladium goes up. Economic booms in big markets like China and the US directly feed this consumption.

- Tighter Emissions Rules: As governments get tougher on pollution, the amount of palladium needed in each catalytic converter often has to increase. This can boost overall demand even if car sales don't change.

- The Rise of Hybrids: While fully electric vehicles are a different ball game, the enduring popularity of hybrid cars keeps palladium in high demand. After all, they still have a petrol engine that needs a catalytic converter.

If you want a solid clue about where palladium's price might be headed, the health of the global car industry and the latest emissions regulations are two of the first places you should be looking.

More Than Just a Car Part

While cars steal the show, palladium’s unique characteristics make it a go-to metal in a few other specialised fields. These industries provide a smaller but steady stream of demand that helps put a floor under its price.

For instance, palladium is a crucial little component in the electronics we can't live without. It’s used to create multilayer ceramic capacitors (MLCCs)—tiny but vital parts you'll find in smartphones, laptops, and just about every other modern gadget. Its ability to resist corrosion while conducting electricity makes it perfect for the job.

You'll also find palladium in some perhaps surprising places:

- Dentistry: Because it's strong and doesn't react with the human body, it's a trusted material for things like crowns and bridges.

- Jewellery: As a naturally white, hypoallergenic precious metal, it's a fantastic alternative to platinum for wedding rings and other fine pieces. With its price coming down recently, it's becoming a more attractive choice again.

And finally, you have the investors. People buy palladium not to use it, but to bet on its future price. They might buy physical bars and coins or invest through financial products like Exchange-Traded Funds (ETFs). This investment activity adds another layer to the demand picture and can have a big impact on short-term price volatility.

Where Palladium Comes From: The Supply Story

To really get a handle on what moves the price of palladium, you have to look past the demand side and dig into its surprisingly fragile supply chain. This isn't a metal you find just anywhere. Unlike commodities like copper or oil that are pulled from the ground all over the world, palladium is only found in commercially viable amounts in a few select places.

This makes its supply incredibly concentrated and, frankly, quite vulnerable. The global palladium market is dominated by just two countries: Russia and South Africa. Between them, they're responsible for over 80% of all newly mined palladium every single year.

That intense geographical concentration is the biggest risk factor on the supply side, hands down. Imagine a global assembly line for a vital car part, but there are only two factories in the world making it. If one of them has a problem—a slowdown, a shutdown, anything—the entire system feels the shock almost instantly.

The Geopolitical Squeeze

Because the supply chain is so tight, it’s extremely sensitive to outside shocks. Things like geopolitical tensions, trade sanctions, or even internal politics in Russia or South Africa can have a massive impact on the global market.

A political spat, a new export tax, or labour strikes at a key mine can choke off the available supply in a heartbeat. This sends a ripple of anxiety through industrial buyers and investors, who then scramble to secure what they can, often sending prices rocketing upwards.

We’ve seen this volatility play out dramatically in Europe, where the motor industry is heavily dependent on these sources. Over the last decade, European palladium prices in EUR per Troy Ounce shot up to a high of €3,076 and dipped to a low of €428.38, a clear reflection of the market reacting to supply fears. You can explore more on these European palladium price trends on BullionByPost.ie.

The takeaway is simple: when supply is this concentrated, the price of palladium is shaped as much by political headlines as it is by economic fundamentals.

Urban Mining: The Rise of Recycling

Thankfully, newly mined metal isn't the only game in town. There's another source that helps bring some stability to the market: recycling. Often called 'urban mining', this is all about recovering precious metals from old, discarded products—and for palladium, that primarily means scrapped catalytic converters.

When older cars are taken off the road, their catalytic converters are collected. The tiny but valuable amounts of palladium inside are then chemically extracted and refined, ready to be used again. This secondary supply has become a vital buffer, feeding a steady stream of metal back into the market and taking some of the pressure off new mining operations.

This recycled supply is important for a few key reasons:

- Reduces Reliance on Primary Sources: It provides a crucial alternative to newly mined palladium, which dials down the market's exposure to geopolitical risks tied to Russia and South Africa.

- Acts as a Market Stabiliser: When palladium prices are high, recycling becomes more profitable. This encourages more scrapped converters to be processed, which increases supply and can help bring overheated prices back down to earth.

- Helps Meet Growing Demand: In an industry that constantly needs more metal, recycled palladium helps bridge the gap between what mines can produce and what car manufacturers need.

This flow of recycled material is a key dynamic for any investor to watch. As the global fleet of petrol and hybrid cars continues to age, the potential reservoir of palladium sitting in old catalytic converters will only get bigger, playing an even more critical role in balancing the delicate supply-demand equation.

How the EV Revolution Is Reshaping Palladium's Future

The unstoppable rise of the electric vehicle (EV) is probably the single biggest threat facing the palladium market. It’s a pretty simple equation: battery-powered cars don't have exhaust pipes, so they have zero need for catalytic converters. When you realise that around 85% of all palladium ends up in these devices, you can see why the EV revolution is a direct hit to the metal’s main source of demand.

This isn't some far-off, theoretical problem—it's happening right now. Governments are pushing hard to phase out petrol and diesel cars, and every EV that leaves the factory is one less petrol vehicle needing a palladium-rich converter. This momentum is already weighing heavily on the price of palladium.

The market sentiment is clearly bearish. Just look at Europe, where palladium prices plunged by 21% between January and June 2023, dropping from 1744 USD/MT to 1367 USD/MT. That dive was largely fuelled by booming EV sales and carmakers swapping out pricey palladium for cheaper platinum to save cash. You can get more detail on how these market shifts impact palladium price trends on procurementresource.com.

A Bridge to an Electric Future

But hold on, it’s not quite as simple as "EVs win, palladium loses." The global switch to a fully electric fleet is going to take decades, not years. In the meantime, hybrid vehicles are the essential bridge technology, and they still have petrol engines kicking in alongside their electric motors.

What this means is that even as fully electric cars gain ground, millions of new hybrids will still be produced, each needing a catalytic converter with palladium. This demand from the hybrid sector acts as a crucial safety net for the palladium market, softening the blow during this transition.

The key takeaway is that while the long-term trend points away from palladium, its role in hybrid vehicles ensures its relevance in the automotive industry for years to come, preventing a sudden collapse in demand.

Beyond the Catalytic Converter

So, is there life for palladium after the internal combustion engine? The answer seems to be a cautious "yes." While nothing can replace the sheer volume of automotive demand just yet, innovation is opening up some new, smaller doors. Researchers are actively exploring how palladium could play a part in new green technologies.

Here are a few potential future uses:

- Hydrogen Fuel Cells: Palladium is brilliant at absorbing and storing hydrogen, which makes it a strong candidate for fuel cell technology—another path to zero-emission transport.

- Groundwater Treatment: It can also work as a catalyst to break down certain nasty industrial pollutants, giving it a potential role in environmental cleanup.

- Advanced Electronics: Its unique properties keep it valuable in specialised electronic components, a sector that never stops growing.

Let’s be realistic: none of these applications are going to replace the demand from catalytic converters overnight. But they do show that innovation could write a completely new chapter for this metal, keeping it relevant even as the world moves beyond fossil fuels.

How to Track and Interpret Palladium Price Moves

Knowing what moves the palladium market is one thing, but actually tracking its price and making sense of the day-to-day swings is where the rubber meets the road. This is where you go from theory to practice, grabbing the tools you need to follow the market and make smarter decisions with real-time data.

First things first, you need to get your head around the difference between the spot price and the futures price. The spot price is simply the "right now" price. If you wanted to buy a troy ounce of palladium for immediate delivery, this is the price you'd pay. It's the number you'll see ticking away on live price charts.

The futures price, on the other hand, is a contract to buy or sell palladium at a set price on a specific date down the line. Big industrial users and financial players use this to hedge their bets and lock in a price today for a delivery they might need in three or six months. For most of us just watching the market, the spot price is the key real-time indicator of what’s happening.

Reading the Charts and Spotting Trends

If you really want to get a feel for palladium's moves, you have to learn the basics of reading price charts. These charts are like a window into the market's collective mind, telling a story of supply, demand, fear, and greed.

You don't need to be a Wall Street pro to spot the fundamental patterns:

- Uptrends: A simple series of higher peaks and higher troughs. This tells you buyers are in control and sentiment is positive.

- Downtrends: The opposite—a pattern of lower peaks and lower troughs, which suggests sellers have the upper hand.

- Volatility: This is just a measure of how much the price is jumping around. When palladium gets choppy, it’s often a sign of uncertainty, maybe triggered by geopolitical news or fresh data from the motor industry.

Think of a price chart as the market's heartbeat. A steady, rhythmic pattern suggests stability, while erratic spikes and dips are like a raised pulse, signalling that something significant is happening that has traders on edge.

Tools for Tracking the Palladium Price

Luckily, you don’t need a fancy trading desk to keep an eye on palladium. Plenty of reliable online sources offer live and historical data, making it easy to stay in the loop. Big-name financial news sites like Bloomberg and Reuters, along with specialised commodity data providers, have free, easy-to-use charts.

For a deeper dive into chart reading, this guide to Master Technical Analysis for Traders is a great place to start. The principles it covers work for any traded asset, including palladium. It’s also worth noting how modern tools are changing the game; you can explore the role of AI in data analytics here to see how technology is shaping market analysis.

By combining good data with a solid grasp of the basics, you can start to decode what the market is telling you.

Your Palladium Questions, Answered

Jumping into the world of precious metals can feel a bit overwhelming, so let's get straight to the point. Here are some of the most common questions I hear about palladium, with clear, no-nonsense answers to help you make sense of it all.

Is Palladium a Good Investment Right Now?

That’s the million-dollar question, isn't it? The truth is, it’s complicated. Palladium is caught in a tug-of-war between two powerful forces. On one side, you have the electric vehicle revolution, which is set to slowly but surely chip away at its main source of demand—catalytic converters in petrol cars. But on the other, it's still essential for hybrid vehicles, and there's always the chance of new uses in green technology popping up.

What does this mean for an investor? Well, palladium has shifted from a simple "buy and hold" metal to more of a tactical asset. Its price can swing wildly based on short-term supply chain hiccups, changes in car manufacturing forecasts, or even just shifts in market mood. It can be a great opportunity if you have a healthy appetite for risk and keep a close eye on the market, but the long-term shadow of EVs makes it a much trickier investment than it was a few years back.

How Can I Invest in Palladium?

If you're ready to get some skin in the game, you have a few solid options. Each route has its own pros and cons when it comes to things like storage, fees, and how easily you can cash out.

- Physical Bullion: This is the old-school way. You buy actual palladium bars and coins from a trusted dealer. You own the metal outright, but you also have to think about secure storage and insurance, which adds to the cost.

- Exchange-Traded Funds (ETFs): Think of these as a basket of palladium held in a secure vault, with shares you can buy and sell just like a stock. It’s a super convenient and liquid way to track the metal's price without ever having to touch the physical product.

- Palladium Futures: Now we're getting into more advanced territory. A futures contract is an agreement to buy or sell palladium at a set price on a future date. It's mainly a tool for seasoned traders and institutions looking to speculate or manage their risk.

For most people just starting, ETFs are probably the most straightforward entry point. But remember, diversification is always a smart move. It can be helpful to see how direct commodity plays stack up against other assets, so you might want to read up on how mutual funds work in Ireland to get a broader perspective.

Will Palladium Price Ever Recover to Its Previous Highs?

While you should never say never in the commodities game, a return to the glory days of $3,000 per ounce feels like a very long shot right now. That incredible peak was fuelled by a perfect storm: booming demand from carmakers, tough new emissions standards, and serious worries about supply.

The market has fundamentally changed since then. The EV transition has put a cap on long-term demand forecasts, and some manufacturers are already swapping out expensive palladium for its cheaper cousin, platinum, wherever they can.

For palladium’s price to truly stage a comeback, we’d need to see something dramatic. Think an unexpected global boom in hybrid car sales, a brand-new industrial use for the metal, or a massive, long-term supply disruption from a key producer like Russia or South Africa.

What Is the Difference Between Palladium and Platinum?

Palladium and platinum are like two peas in a pod—they're part of the same metal group—but they have some crucial differences in how they're used and valued. Both are fantastic in catalytic converters, but palladium works best in petrol engines, while platinum has historically been the go-to for diesel.

For years, platinum was the more expensive of the two. That flipped completely when demand for petrol cars went through the roof, sending palladium’s price into the stratosphere. Now that palladium has come back down to earth, it’s becoming an attractive choice again, especially in areas like jewellery, where it’s a tough, naturally white metal that competes well with white gold.

Discover more from Scott Dylan

Subscribe to get the latest posts sent to your email.